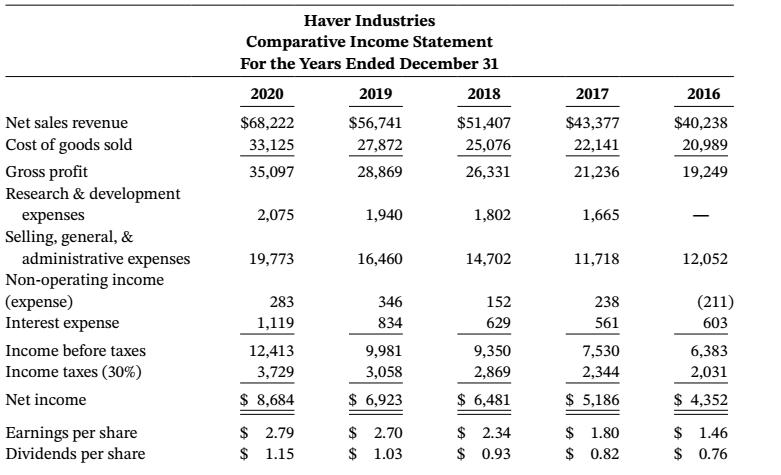

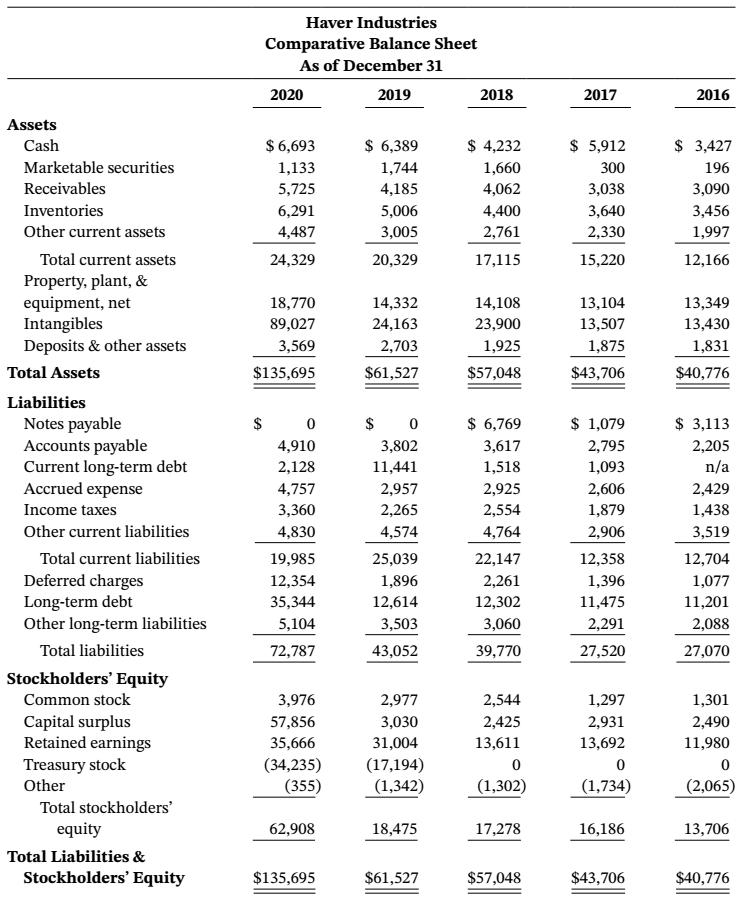

Haver Industries is a leading consumer products company. The companys adapted comparative balance sheets and income statements

Question:

Haver Industries is a leading consumer products company. The company’s adapted comparative balance sheets and income statements (in $ millions) follow.

Required

a. In his letters to stockholders in 2016, Haver’s CEO stated that the company’s goal for the next five years was to achieve 4% to 6% sales growth each year and at least 10% growth in earnings per share. Based on the results shown here, did the company meet its targets? How do you know?

b. Managing a broad collection of brands is challenging. In its 2016 annual report, Haver Industries stated that acquisitions and divestitures “are part of the Company’s strategic focus on developing brands that offer the greatest potential for growth.” The report went on, “This requires some difficult decisions, including a restructuring program to reduce overhead and streamline manufacturing processes.” In other words, the company strives to use its assets to earn the greatest possible return. How well has the company managed its assets over the five-year period shown here?

c. Would you recommend Haver Industries shares to a friend who is interested in investing for growth potential? Why or why not?

Step by Step Answer: