a. Mr. Krog is not convinced by Peters analysis and has turned to you, an outside consultant,

Question:

a. Mr. Krog is not convinced by Peter’s analysis and has turned to you, an outside consultant, to provide a preliminary estimate of lost profit. Using the limited information contained in the financial statements for 2019 and 2020, estimate lost profits.

STEP 1. Determine the level of fixed and variable costs in 2019 as a function of sales. You can use account analysis, the high-low method, or regression if you are familiar with that technique. If you use account analysis, assume that cost of goods sold and selling expense are variable costs and administrative expense is a fixed cost.

STEP 2. Predict what sales would have been in 2020 if there was no fire. Using this level of sales and the fixed and variable cost information from Step 1, estimate what profit would have been in 2020.

STEP 3. The difference between actual profit in 2020 and the amount estimated in Step 2 is lost profit.

b. Based on your preliminary analysis, do you recommend that Mr. Krog aggressively pursue a substantial claim for lost profit?

c. What is the fundamental flaw in Peter Newell’s analysis?

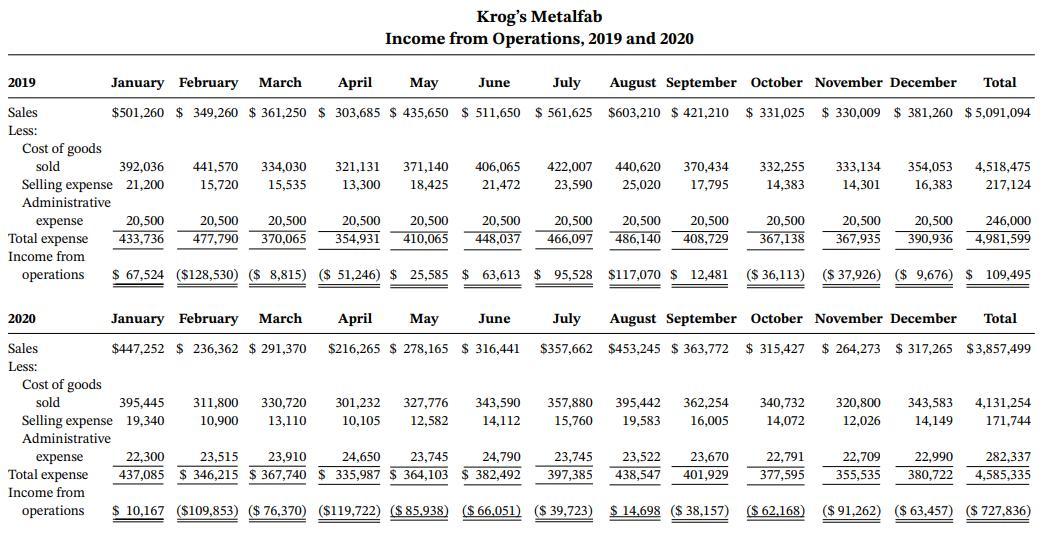

John Krog is president, chairman of the board, production supervisor, and majority shareholder of Krog’s Metalfab, Inc. He formed the company in 1991 to manufacture custom-built aluminum storm windows for sale to contractors in the greater Chicago area. Since that time the company has experienced tremendous growth and currently operates two plants: one in Chicago, the main production facility, and a smaller plant in Moline, Illinois. The company now produces a wide variety of metal windows, framing materials, ladders, and other products related to the construction industry. Recently the company developed a new line of bronze-finished storm windows, and initial buyer reaction has been quite favorable. The company’s future seemed bright, but on January 3, 2020, a light fixture overheated causing a fire that virtually destroyed the entire Chicago plant. Three days later, Krog had moved 50 percent of his Chicago workforce to the Moline plant. Workers were housed in hotels, paid overtime wages, and provided with bus transportation home on weekends. Still, the company could not meet delivery schedules because of reduced operating capacity, and total business began to decline. At the end of 2020, Krog felt that the worst was over. A new plant had been leased in Chicago, and the company was almost back to normal.

Finally, Krog could turn his attention to a matter of considerable importance: settlement with the insurance company. The company’s policy stipulated that the building and equipment loss be calculated at replacement cost. This settlement had been fairly straightforward, and the proceeds had aided the rapid rebuilding of the company. A valued feature of the insurance policy was “lost profit” coverage. This coverage was to “compensate the company for profits lost due to reduced operating capacity related to fire or flood damage.” The period of “lost profit” was limited to 12 months. Interpreting the exact nature of this coverage proved to be difficult. The insurance company agreed to reimburse Krog for the overtime premium, transportation, and housing costs related to operating out of the Moline plant. These expenses obviously minimized the damages related to the 12 months of lost or reduced profits. But was the company entitled to any additional compensation?

Krog got out the latest edition of Construction Today. According to this respected trade journal, sales of products similar to products produced by Krog’s Metalfab had increased by seven percent during 2020. Krog felt that were it not for the fire, his company could also have increased sales by this percentage. Income statement information is available for 2019 (the year prior to the fire) and 2020 (the year during which the company sustained “lost profit”). The expenses in 2020 include excess operating costs of $250,000. Krog has documentation supporting these items, which include overtime costs, hotel costs, meals, and such related to operating out of Moline. The insurance company is quite willing to pay for these costs since they reduced potential lost profit. The chief accountant at Krog, Peter Newell, has estimated lost profit to be only $34,184. Thus, he does not feel that it’s worthwhile spending a lot of company resources trying to collect more than the $250,000. Peter arrived at his calculation as follows:

Sales in 2019....................................................................$5,091,094

Predicted sales in 2020, assuming a 7% increase........$5,447,471

Actual sales in 2020...........................................................3,857,499

(A) Lost sales......................................................................1,589,972

(B) Profit in 2019 as a percentage of 2019 sales ($109,495 ÷ 5,091,094).................................................................................(.0215)

Lost profit (A × B)..................................................................$ 34,184

Step by Step Answer: