Balmer is a West Coast company with more than 400 drug stores. Financial information for fiscal 2020

Question:

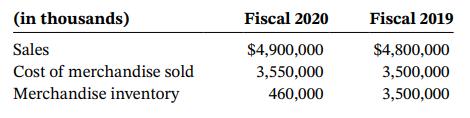

Balmer is a West Coast company with more than 400 drug stores. Financial information for fiscal 2020 and 2019 follows:

An excerpt from management discussion and analysis (MD&A) in the fiscal 2020 annual report stated:

Gross profit was 27.6% of sales in fiscal 2020, compared to 27% in fiscal 2019. The slight increase was primarily due to a more profitable sales mix, improved inventory management, and the increased utilization of generic drugs, which generally have higher gross profit percentages than name-brand drugs. Better buying practices resulting from our progress in centralizing procurement, advertising, and promotional activities also contributed to our improved gross profit percentage. Continued reductions in prescription drug reimbursement rates from third-party health plans, including government-sponsored plans such as Medi-Cal, partially offset the increase in our gross profit percentage. In addition, pharmacy sales have lower gross profit percentages than front-end sales. Finally, as pharmacy sales continued to grow as a percent of total sales, our overall gross profit as a percent of sales was adversely impacted.

Required

a. Compute the gross margin percentage for both years.

b. Based on your evaluation of the change in the gross margin percentage and the discussion in the MD&A, comment on how well the company has managed its gross margin.

c. Compute inventory turnover and days’ sales in inventory for both years.

Step by Step Answer: