Consider the following information for Executive Electronics: Required a. Evaluate the companys performance for 2020 and 2021

Question:

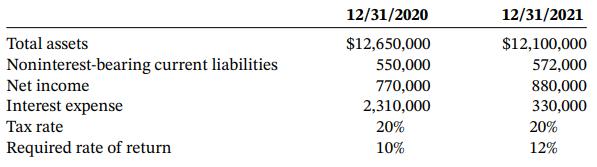

Consider the following information for Executive Electronics:

Required

a. Evaluate the company’s performance for 2020 and 2021 in terms of residual income (RI), which is equivalent to EVA since there are no adjustments for accounting distortions.

b. While income has increased in fiscal 2021, is it clear that the company’s performance has improved?

c. (Optional) Explain why the required rate of return increased in fiscal 2021.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: