Consider the following information for HandyCraft Stores for 2020 and 2021: Required a. Compute ROI for both

Question:

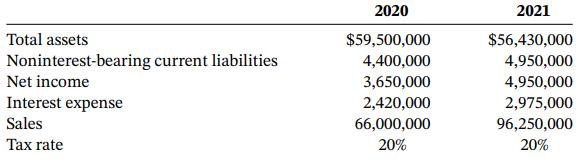

Consider the following information for HandyCraft Stores for 2020 and 2021:

Required

a. Compute ROI for both years.

b. Break ROI down into profit margin and investment turnover.

c. Comment on the change in financial performance between 2020 and 2021.

Transcribed Image Text:

2020 2021 Total assets $59,500,000 $56,430,000 Noninterest-bearing current liabilities Net income 4,400,000 4,950,000 3,650,000 4,950,000 Interest expense 2,420,000 2,975,000 Sales 66,000,000 96,250,000 Tax rate 20% 20%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

a 2020 2021 Net income 3650000 4950000 Pus interest 2420000 2975000 Less tax effect of int...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the following information for HandyCraft Stores for 2011 and 2012. Required a. Compute ROI for both years. b. Break ROI down into profit margin and investment turnover. c. Comment on the...

-

Consider the following information for HandyCraft Stores for 2011 and 2012. Required a. Compute ROI for both years. b. Break ROI down into profit margin and investment turnover. c. Comment on the...

-

Consider the following information for HandyCraft Stores for 2017 and 2018: Required a. Compute ROI for both years. b. Break ROI down into profit margin and investment turnover. c. Comment on the...

-

Examine the articles reproduced below and consider how the five C's discussed in the course have application in the present coronavirus pandemic. "To the extent that an environment characterized by...

-

(a) Suppose that the reservoir in Figure 25-8 contains 1.5 L of 2.0 M K2PO4. For how many hours can the reservoir provide 20 mM KOH at a flow rate of 1.0 mL/min if 75% consumption of K+ in the...

-

We read your letter, requesting your deposit refund. We couldnt figure out why you hadnt received it, so we talked to our maintenance engineer, as you suggested. He said you had left one of the doors...

-

A proton has mass \(m_{p}\) and charge \(+e\). The force it exerts on another proton at a distance \(r\) is given by \(F(r)=\frac{1}{4 \pi \in_{0}} \frac{e^{2}}{r^{2}}\) where \(\frac{1}{4 \pi...

-

When interest rates decline, Patriot Bank has found that they get inundated with requests to refinance home mortgages. To better plan its staffing needs in the mortgage processing area of its...

-

QUESTION THREE (a) (b) Joseph intends to start a small business specializing in software development to cater for the youth; however a business consultant has advised him to be extra careful before...

-

5.18 Length of a movie on Netflix. Flixable reports that Netflix's U.S. catalog contains almost 4000 movies.2 You are interested in determining the average length of these movies. Previous studies...

-

The chief operating officer of the Wisconsin Corporation is considering the effect of depreciation on the companys ROI. In the most recent year, net operating profit after taxes was $35,000,000 and...

-

Atomic Electronics is considering instituting a plan whereby managers will be evaluated and rewarded based on a measure of economic value added (EVA). Before adopting the plan, management wants you...

-

A survey asked 50 baseball fans to report the number of games they attended last year. The results are listed here. Use an appropriate graphical technique to present these data and describe what you...

-

Tesmar Corp's current earnings per share is $6 and it has a return of equity is 12%. The management plans to indefinitely maintain its plowback ratio to 2/3. An annual dividend was just paid. Assume...

-

Provide sample output after coding. There are several samples output to look. This is sample output that needs code. I need the code in java netbeans. I need the code to be exactly the same from the...

-

2 kg of air at 600 kPa and 40C are heated in a rigid container to 250C. Determine the entropy change of air during this process assuming: (a) Constant heat capacity. (5 pts) (b) Variable heat...

-

Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $30,000 in the risk-free asset and $70,000 in GM stock. He wants to...

-

An object moves along one dimension with a constant acceleration of 3.35 m/s over a time interval. At the end of this interval it has reached a velocity of 13.6 m/s. (a) If its original velocity is...

-

In Figure 26.17 light strikes the surface of a liquid at the Brewster angle, and the reflected light is 100% polarized. Suppose the light originates in air and the angle of refraction in Figure 26.17...

-

What are the main distinctions between the different schools of legal interpretation?

-

Expected manufacturing costs for Imperial Data Devices are as follows: Required Estimate manufacturing costs for production levels of 13,000 units, 15,000 units, and 17,000 units permonth. Variable...

-

Prepare a performance report for Imperial Data Devices using the budget information from Exercise 10-15 and the next performance information. In Exercise 10-15, Expected manufacturing costs for...

-

At the start of 2012, the New Orleans Fine Food Company budgeted before-tax income as follows: Actual before tax income for 2012 was: Required Florence Roden, the owner of the company, is pleased...

-

Frank is 82 years old.His wife died 5 years ago.He died and left the following assets: Principal residence 859,000 (individually owned: ACB 350,000) RRIF $235,000 (Beneficiary adult daughter ACB...

-

Assume that Pope Enterprises held a $10,000, 10 percent, six-month note signed by Mary Drew. On December, 1, 2015, the maturity date, Drew dishonored the note. At this point, Drew owes a total of...

-

5. Consider the shape shown on the following graph and the brute force method of solving the convex hull problem 2 -2 -1 0 a. Label all the points that will be provided to the algorithm as input. You...

Study smarter with the SolutionInn App