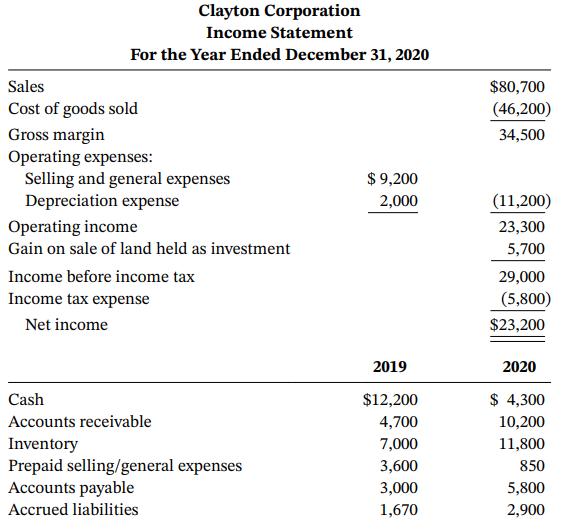

Following is an income statement for the Clayton Corporation for the year ended December 31, 2020, and

Question:

Following is an income statement for the Clayton Corporation for the year ended December 31, 2020, and a schedule listing the company’s current assets and current liabilities at the end of 2019 and 2020.

Required

a. Prepare a schedule documenting the Clayton Corporation’s net cash flow from operating activities for the year ended December 31, 2020, using the indirect method.

b. Prepare a schedule documenting the Clayton Corporation’s net cash flow from operating activities for the year ended December 31, 2020, using the direct method. Assume that selling and general expenses are related to both prepaid expenses and accrued liabilities.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: