Modern Healthcare, a group practice clinic with 10 physicians, had the following income in 2020: The following

Question:

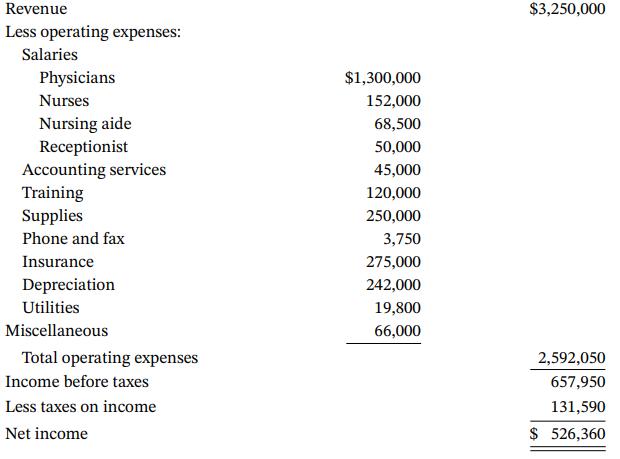

Modern Healthcare, a group practice clinic with 10 physicians, had the following income in 2020:

The following changes are expected in 2021:

1. The clinic is expecting a two percent decline in revenues because of increasing pressure from insurance companies.

2. Physicians are planning to hire a physician assistant at a salary of $50,000 per year.

3. Training costs are expected to increase by $15,000.

4. Supplies are expected to increase to be 10 percent of revenue.

5. Phone, fax, and insurance amounts will stay the same.

6. Depreciation expense will increase by $20,000 per year, since the clinic is planning to purchase equipment for $125,000.

7. Utilities and miscellaneous expenses are expected to increase by five percent next year. 8. Taxes on income will be 20 percent.

Required

Prepare a budgeted income statement for Modern Healthcare for the year 2021.

Step by Step Answer: