Instant Pix Inc. produces photographic paper for printing digital images. One of the processes for this operation

Question:

in prices for inputs are not an explanation for increasing costs. However, you have discovered three possible problems from some of the operating personnel whose quotes follow:

Operator 1:€œI€™ve been keeping an eye on my operating room instruments. I feel as though our energy consumption is becoming less efficient.€

Operator 2:€œEvery time the coating machine goes down, we produce waste on shutdown and subsequent startup. It seems like during the last half year we have had more unscheduled machine shutdowns than in the past. Thus, I feel as though our yields must be dropping.€

Operator 3:€œMy sense is that our coating costs are going up. It seems to me like we are spreading a thicker coating than we should. Perhaps the coating machine needs to be recalibrated.€

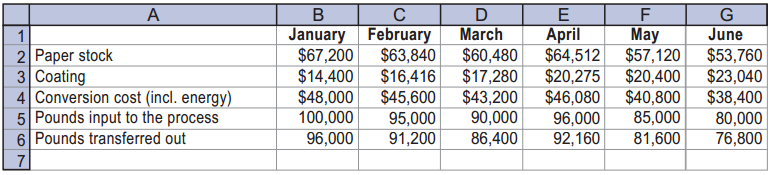

The Coating Department had no beginning or ending inventories for any month during the study period. The following data from the cost of production report are made available:

a. Prepare a table showing the paper cost per output pound, coating cost per output pound, conversion cost per output pound, and yield (pounds out/pounds input) for each month.

b. Interpret your table results.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted: