Raul Martinas, a professor of languages at Eastern University, owns a small office building adjacent to the

Question:

Raul Martinas, a professor of languages at Eastern University, owns a small office building adjacent to the university campus. He acquired the property 10 years ago at a total cost of $530,000?that is, $50,000 for the land and $480,000 for the building. He has just received an offer from a realty company that wants to purchase the property; however, the property has been a good source of income over the years, and so Martinas is unsure whether he should keep it or sell it. His alternatives are as follows:

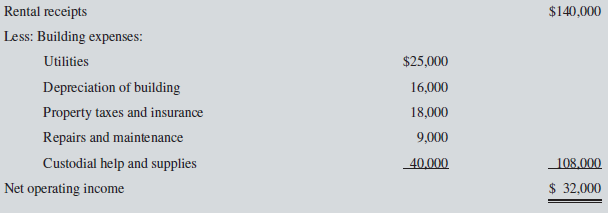

a. Keep the property. Martinas?s accountant has kept careful records of the income realized from the property over the past 10 years. These records indicate the following annual revenues and expenses:

Professor Martinas makes a $12,000 mortgage payment each year on the property. The mortgage will be paid off in eight more years. He has been depreciating the building by the straight-line method, assuming a salvage value of $80,000 for the building, which he still thinks is an appropriate figure. He feels sure that the building can be rented for another 15 years. He also feels sure that 15 years from now the land will be worth three times what he paid for it.

b. Sell the property. A realty company has offered to purchase the property by paying $175,000 immediately and $26,500 per year for the next 15 years. Control of the property would go to the realty company immediately. To sell the property, Professor Martinas would need to pay the mortgage off, which could be done by making a lump-sum payment of $90,000.

Required:

Assume that Professor Martinas requires a 12% rate of return. Would you recommend that he keep or sell the property? Show computations using the total cost approach to net present value.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan