Siegel Corporation manufactures a product available in both a deluxe and a regular model. The company has

Question:

Siegel Corporation manufactures a product available in both a deluxe and a regular model. The company has made the regular model for years; the deluxe model was introduced several years ago to capture a new segment of the market. Since the introduction of the deluxe model, the company?s profits have steadily declined, and management has become concerned about the accuracy of its costing system. Sales of the deluxe model have been increasing rapidly.

Overhead is applied to products on the basis of direct labour-hours. At the beginning of the current year, management estimated that $5,184,000 in overhead costs would be incurred and the company would produce and sell 5,000 units of the deluxe model and 40,000 units of the regular model. The deluxe model requires 3.2 hours of direct labour time per unit, and the regular model requires 0.8 hours. Materials and labour costs per unit follow:

Required:

1. Compute the predetermined overhead rate using direct labour-hours as the basis for allocating overhead costs to products. Compute the unit product cost for one unit of each model.

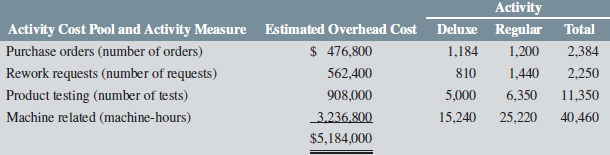

2. An intern suggested that the company use activity-based costing to cost its products. A team was formed to investigate this idea, and it came back with the recommendation that four activity cost pools be used. These cost pools and their associated activities follow:

Compute the activity rate (i.e., predetermined overhead rate) for each of the activity cost pools.

3. Assume that actual activity is as expected for the year. Using activity-based costing, do the following:

a. Determine the total amount of overhead that would be applied to each model for the year.

b. Compute the unit product cost for one unit of each model.

4. Can you identify a possible explanation for the company?s declining profits? If so, what is it?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan