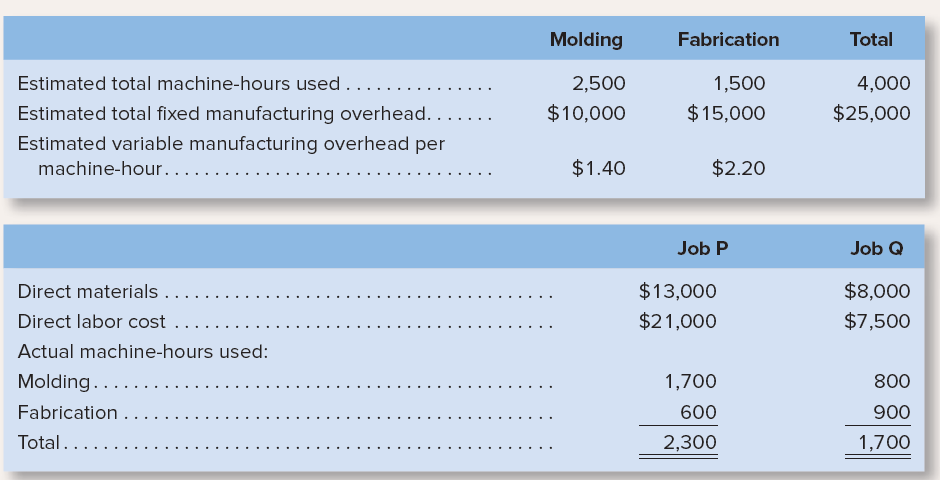

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The

Question:

only two jobs during March€”Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

Required:

For questions 1€“8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9€“15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.

1. What was the company€™s plantwide predetermined overhead rate?

2. How much manufacturing overhead was applied to Job P and how much was applied to Job Q?

3. What was the total manufacturing cost assigned to Job P?

4. If Job P included 20 units, what was its unit product cost?

5. What was the total manufacturing cost assigned to Job Q?

6. If Job Q included 30 units, what was its unit product cost?

7. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis?

8. What was Sweeten Company€™s cost of goods sold for March?

9. What were the company€™s predetermined overhead rates in the Molding Department and the Fabrication Department?

10. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q?

11. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q?

12. If Job P included 20 units, what was its unit product cost?

13. If Job Q included 30 units, what was its unit product cost?

14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis?

15. What was Sweeten Company€™s cost of goods sold for March?

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259917066

8th edition

Authors: Peter C. Brewer, Ray H Garrison, Eric Noreen