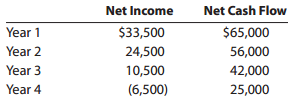

The following data are accumulated by Parker Company in evaluating the purchase of $126,000 of equipment, having

Question:

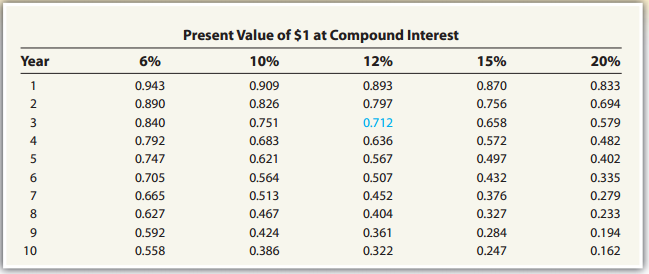

a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table of the present value of $1 appearing in Exhibit 1 of this chapter.

b. Would management be likely to look with favor on the proposal? Explain.

Exhibit 1:

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted: