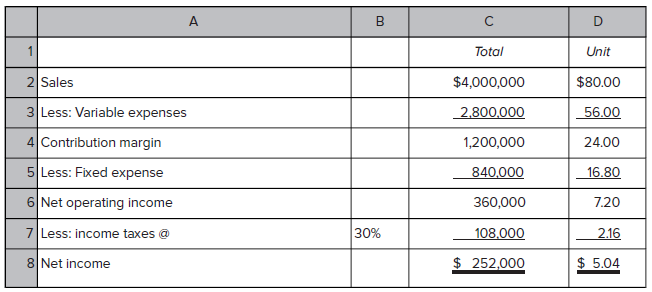

The income statement for Huerra Company for last year is provided below: The company had average operating

Question:

The income statement for Huerra Company for last year is provided below:

The company had average operating assets of $2,000,000 during the year.

Required:

1. Compute the company?s ROI for the period using the ROI formula stated in terms of margin and turnover.

2. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in part (1).

a. By using JIT, the company is able to reduce the average level of inventory by $600,000. (The released funds are used to pay off short-term creditors.)

b. The company achieves a savings of $2 per unit by using cheaper materials.

c. The company issues bonds and uses the proceeds to purchase machinery and equipment, thus increasing the average assets by $600,000. Interest on the bonds is $60,000 per year. Sales remain unchanged. The new more efficient equipment reduces fixed production costs by $30,000 per year.

d. As a result of a more intense effort by the sales staff, sales are increased by 10%; operating assets remain unchanged.

e. Obsolete items of inventory carried on the records at a cost of $120,000 are scrapped and sold for 10% of the book value.

f. The company uses $200,000 in cash (received on accounts receivable) to repurchase and retire some of its common shares.

g. The company pays a cash dividend to its shareholders, which results in a $300,000 change in average operating assets.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan