The Red Company is a relatively new company. The company?s accountant has assembled the following information pertaining

Question:

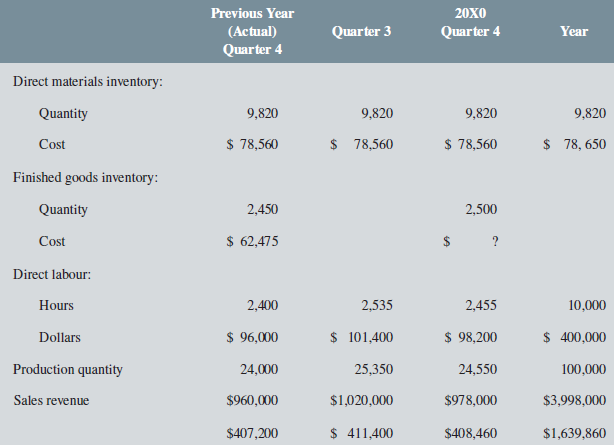

The Red Company is a relatively new company. The company?s accountant has assembled the following information pertaining to the company?s operations budget for the year ended December 31, 20X0:

Sales price.........................................................................$40 per unitDirect materials cost........................................................$8 per unit of direct materialsDirect materials required for production......................2 units per unit of productBudgeted direct labour cost............................................$40 per hourVariable manufacturing overhead rate.........................$25 per direct labour-hourDepreciation (non-mfg)....................................................$160,000Factory depreciation........................................................$240,000Budgeted fixed manufacturing overhead.....................$140,000 excluding depreciation

Required:

1. Calculate the predetermined overhead rate per direct labour-hour for the year and the overhead cost per unit.

2. Calculate the total manufacturing cost for 20X0, the budgeted production cost per unit of finished goods for 20X0, and the value of the 20X0 ending finished goods inventory for the year.

3. Calculate the cash disbursement relating to the manufacturing activity for the fourth quarter. Assume that the purchases made in a quarter are paid in the quarter of the purchase and the following quarter in equal proportion. Also assume that the fixed overhead cash expenditures occur evenly throughout the year.

4. Your friend responds to the previous question by calculating the cost of goods sold. Explain if you agree with your friend?s approach.

5. Prepare, in good form, the budgeted annual income statement for the year ended December 31, 20X0, including the schedule of the cost of goods manufactured.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan