You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise

Question:

You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations:

a. The cash balance on December 1 is $40,000.

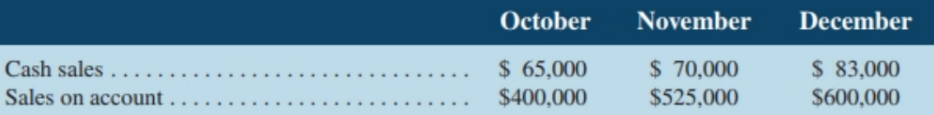

b. Actual sales for October and November and expected sales for December are shown below. Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible

c. Purchases of inventory will total $280,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $ 61,000, all of which will be paid in December.

d. Selling and administrative expenses are budgeted at $430,000 for December. Of this amount, $50,000 is for depreciation.

e. A new web server for the Marketing Department costing $76,000 will be purchased for cash during December, and dividends totaling $9,000 will be paid during the month.

f. The company maintains a minimum cash balance of $20,000. An open line of credit is available from the company's bank to bolster the cash position as needed.

Required:

1. Prepare a schedule of expected cash collections for December.

2. Prepare a schedule of expected cash disbursements during December for merchandise purchases.

3. Prepare a cash budget for December. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest will not be paid until the following month.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby