Zinn Corporation recently agreed to a union contract provision that guarantees a minimum wage of $1,250 per

Question:

Zinn Corporation recently agreed to a union contract provision that guarantees a minimum wage of $1,250 per month to each direct labour employee equivalent to 125 hours of work each month. Currently, 125 employees are covered by this provision. All direct labour employees are paid $10 per hour. Thus, until an employeeworks 125 hours, the remenuration is a fixed $1,250 per employee each month. Rusty Zinn, the assistant to the accountant was given the task of budgeting for the direct labour cost. Because of the contract provision, Rusty decided that the $156,250 (= 125 ? $1,250 per month) should be treated as a fixed monthly cost. Rusty was instructed to calculate each month?s budget using the following formula: $156,250+$7 per direct labour-hour.

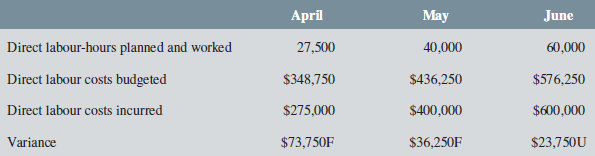

Figures for the first three months of the fiscal year are as follows:

These figures are a source of concern because they show unfavourable variances when production is high, and favourable variances during slow months. The factory manager is certain that this trend does not reflect reality.

Required:

1. Explain why the variance is favourable during slow months and unfavourable in months when production is high. A diagram may help you to develop an explanation.

2. Develop a formula for direct labour costs more appropriate to the actual cost behaviour, then recalculate the variances for April, May, and June.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan