Assume that a salesperson, Edwynn Phillips, has the following annual compensation package: C = $15,000 + 0.2(own

Question:

Assume that a salesperson, Edwynn Phillips, has the following annual compensation package:

C = $15,000 + 0.2(own sales)

This compensation plan induces Ed to exert a given level of effort in selling. Given this effort level, expected sales are $30,000 per year.

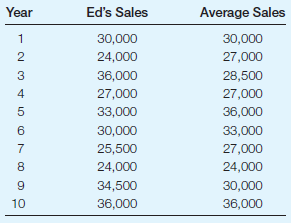

Below are 10 years' worth of data for Ed's sales and the average sales for other employees in the company (Ed's own sales are excluded in calculating this average). The expected value of average sales is also $30,000. However, in any given year, average sales might rise or fall, depending on general economic conditions, and so on. Some of these same conditions affect Ed's sales. Ed has no impact on the average sales for other employees.

1. Based on the 10 years of data, calculate Ed's average annual pay and standard deviation under the existing compensation plan.2. Calculate Ed's average pay and standard deviation under the alternative plan:

$21,000 + 0.2(own sales - average sales)

We adjust the intercept of the pay plan by $6,000 to reflect Ed's average loss imposed on the employee by subtracting 0.2 (average sales) from the compensation. This adjustment keeps the expected pay the same as before. Also, the sample mean of average sales over a 10-year period need not equal the expected value of $30,000.3. Does including the average sales in the pay package alter Ed's incentives to work hard? Explain. (Assume that Ed cannot affect the average by collusion, sabotage, etc.)4. Is this pay plan superior to the original plan from a risk-sharing standpoint?5. Devise an even better plan using the more general form:

C = a + 0.2(own sales λaverage sales)

6. Calculate the average pay and standard deviation for this plan.

Step by Step Answer:

Managerial Economics and Organizational Architecture

ISBN: 978-0073523149

6th edition

Authors: James Brickley, Clifford W. Smith Jr., Jerold Zimmerman