Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns

Question:

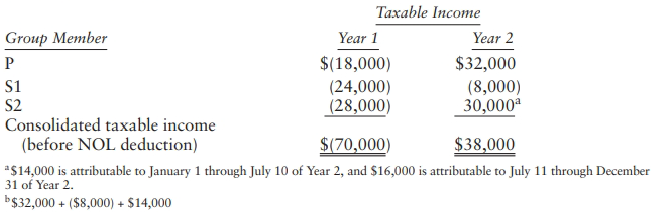

Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 3, P sells all of its 52 stock. The group reports the following results:

In what year(s) can the corporations deduct the Year 1 consolidated NOL? Assume that Year 1 is 2018 or a later year.

Transcribed Image Text:

Тахаble Income Group Member Year 1 Year 2 $(18,000) (24,000) (28,000) $32,000 (8,000) 30,000° S1 S2 Consolidated taxable income (before NOL deduction) *$14,000 is attributable to January 1 through July 10 of Year 2, and $16,000 is attributable to July 11 through December $(70,000) $38,000 31 of Year 2. b$32,000 + ($8,000) + $14,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

The group first carries over the 70000 NOL to Year 2 offsetting 30400 080 380...View the full answer

Answered By

Akshay Singla

as a qualified engineering expert i am able to offer you my extensive knowledge with real solutions in regards to planning and practices in this field. i am able to assist you from the beginning of your projects, quizzes, exams, reports, etc. i provide detailed and accurate solutions.

i have solved many difficult problems and their results are extremely good and satisfactory.

i am an expert who can provide assistance in task of all topics from basic level to advance research level. i am working as a part time lecturer at university level in renowned institute. i usually design the coursework in my specified topics. i have an experience of more than 5 years in research.

i have been awarded with the state awards in doing research in the fields of science and technology.

recently i have built the prototype of a plane which is carefully made after analyzing all the laws and principles involved in flying and its function.

1. bachelor of technology in mechanical engineering from indian institute of technology (iit)

2. award of excellence in completing course in autocad, engineering drawing, report writing, etc

4.70+

48+ Reviews

56+ Question Solved

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted:

Students also viewed these Business questions

-

P and S Corporations comprise an affiliated group that files separate tax returns. P and Shad no intercompany inventory sales before the current year (Year 1). P and S use the first-in, first-out...

-

What is the purpose of the gift tax annual exclusion?

-

In March 1976, Sue made a taxable gift of $200,000. In arriving at the amount of her taxable gift, Sue elected to deduct the $30,000 specific exemption then available. In 2018, Sue makes her next...

-

Jacky Ma Ltd sells a single product called Alibaba. During 2020, 10,000 units were produced and 9,500 units were sold. There was no work-in-process inventory on 31 December 2020, that is the...

-

Find the (straight-line) distance between the points whose spherical coordinates are (8, /4, /6) and (4, /3, 3/4).

-

Write a Python program that simulates a handheld calculator. Your program should process input from the Python console representing buttons that are pushed, and then output the contents of the screen...

-

Barbara Vigil, Chief Justice, New Mexico Supreme Court Ken Badilla bought a pair of Brahma brand work boots from Wal-Mart on October 19, 2003. The boots packaging had these express descriptions: iron...

-

Gross Profit Method On April 15, 2011, fire damaged the office and warehouse of Stanislaw Corporation. The only accounting record saved was the general ledger, from which the trial balance below was...

-

Prepare journal entry for December 31 adjusting entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"...

-

Visit a local supermarket and sketch its layout. What are your observations regarding departments and their locations?

-

P and S Corporations form in Year 1, with S as P's wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results: In what...

-

P Corporation owns 100% of S Corporation's stock, and S owns 100% of T Corporation's stock. The three corporations have filed consolidated tax returns for several years. On January 1 of the current...

-

Ask students to find three ads that contain symbolism. Examine the symbols and discuss the meaning the symbols convey. Encourage the student to identify the different types of signs used in the ads...

-

What is a data class in Kotlin? What is String interpolation in Kotlin? What do you mean by destructuring in Kotlin? What is lateinit? How to check if a lateinit variable has been initialized or not?...

-

Use this spreadsheet link: https://ungprod-my.sharepoint.com/:x:/g/personal/dgash0172_ung_edu/Eee4cEX66oRIrOyv8XI5ZQYB0nUyCdcGiaowUqs2fsIi1Q?e=x1U4Yk To answer these questions: Questions: Use the...

-

Purpose This assignment introduces you to the acm.graphics package which we will be using to create graphics and animation. You'll see an example and then modify it to create shapes on the screen...

-

Banco Pacfico discounted a document of 12,000,000 that expires in 75 days and buy it at 25%. After 12 days, he sells the same document at Banco Caribe, which applied a simple discount rate of 24%,...

-

1.) Describe 5 different types of data distributions. You may include jpegs or bitmaps. Provide 2 examples of a variable that is representative for each distribution. You may not use the standard...

-

Cite the law of reflection.

-

Define a traverse in Surveying?

-

Consumer services tend to be intangible, and goods tend to be tangible. Use an example to explain how the lack of a physical good in a pure service might affect efforts to promote the service.

-

Explain some of the different aspects of the customer experience that could be managed to improve customer satisfaction if you were the marketing manager for: ( a ) an airport branch of a rental car...

-

Is there any difference between a brand name and a trademark? If so, why is this difference important?

-

The idea of a social contract is a powerful concept, but cannot be brought to life without active measures in society by all actors. South Africa can be argued to have a flawed version in place, but...

-

What is supplier economies and educational economies of scale in regards to external economies of scale? (section of my notes below, does not makes sense to me) Educational economies: local colleges...

-

Western Wholesale Foods incurs the following expenditures during the current fiscal year. Required: How should Western account for each of these expenditures? 1. Salaries for the repair technicians,...

Study smarter with the SolutionInn App