Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over

Question:

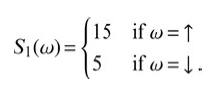

Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over one period of time is r = 25% and the initial value of the stock is S0 = $10. There are two possible states of the world at t = 1, say ?up? and ?down,? and the stock takes values

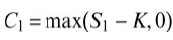

Now a call option on the stock is introduced into the market. Its payoff function is

with exercise price K = $13. Compute the risk neutral probabilities and the fair price C0 of the derivative contract.

(15 if w=1 S1(w) = 15 if w = Į. |C = max(Sj – K,0)

Step by Step Answer:

The risk neutral probabilities can be calculated as pup r dd...View the full answer

Related Video

A call option is a type of financial contract that gives the holder the right, but not the obligation, to buy an underlying asset (such as a stock, commodity, or currency) at a specified price (called the strike price) within a specified period of time. When an investor purchases a call option, they are essentially betting that the price of the underlying asset will rise above the strike price before the option\'s expiration date. If the price of the asset does rise above the strike price, the investor can exercise the option by buying the asset at the strike price and then selling it at the higher market price, thereby earning a profit. Call options are often used as a speculative investment strategy, as they allow investors to potentially profit from the upward movement of an asset without having to actually own the asset itself. They are also commonly used as a hedging tool to protect against potential losses in a portfolio.

Students also viewed these Business questions

-

A one-year long forward contract on a non-dividend-paying stock is entered into when the stock price is $40 and the risk-free rate of interest is 10% per annum with continuous compounding. a) What...

-

A company has assets with a market value of $100. It has one outstanding bond issue, a zero coupon bond maturing in two years with a face value of $75. The risk-free rate is 5 percent. The volatility...

-

The market value of Fords' equity, preferred stock and debt are $7 billion, $3 billion, and $10 billion, respectively. Ford has a beta of 1.8, the market risk premium is 7%, and the risk-free rate of...

-

How can adults continue to function relatively normally after surgery to remove the thymus, tonsils, spleen, or lymph nodes?

-

Write an equation for the reaction of bromine at room temperature with a. Propene b. 4-methylcyclohexene

-

Why are both soft and hard measures of service quality needed?

-

Lynn Goldsmith is a photographer known for her photographs of famous musicians. In 1981, Goldsmith had a photography session with the singer Prince. Three years later, Vanity Fair obtained a license...

-

The following information was in the annual report of Rover Company: Required a. Based on these data, compute the following for 2009, 2008, and 2007: 1. Percentage of earnings retained 2....

-

An 85 kg man is completing a workout with TRX suspension straps. Holding this position in static equilibrium he experiences a pulling force on his hands of 600 N at an angle of 160 o relative to the...

-

Michelle French owns and operates Books and More, a retail book store. Selected account balances on June 1 are as follows: General Ledger Cash ............... $32,200.00 Accounts Payable ..............

-

Consider the payoff matrix Check if the financial market is complete, and whether or not any cyclical permutation of the security price form results in an arbitrage free market. (1 2 D= 3 (s] = (1 2...

-

Convince yourself that the set K in Figure 5.2 left is not convex. Figure 5.2. K M

-

What type of products are produced by roll bending?

-

Should a Web site be considered a form of property? In what ways should it be treated differently from physical property?

-

I need a 100 word discussion reply to: Accounting Information Systems can be viewed through biblical principles by emphasizing honesty, integrity, and accountability. The Bible encourages...

-

Based on the topic you choose, you need to develop your own thesis and then explore that thesis in a critical way in your essay. Topic: 1) Define what virtue is according to Aristotle. How many types...

-

Take the following data table and calculate the Real Value when the Base value is set at 2009. Please show your work for partial credit. Note: Use 4 Digit Decimal Precision When Re-Indexing CPI. Year...

-

Solve the formula for the specified variable. S=2LW+2LH + 2WH L =

-

Illustrate the effects on the accounts and financial statements of the following related transactions of Bowen Inc. a. Purchased $400,000 of merchandise from Swanson Co. on account, terms 1/10, n/30....

-

"Standard-cost procedures are particularly applicable to process-costing situations." Do you agree? Why?

-

Sam and Taylor, residents of New Jersey, entered in to a domestic partnership in New Jersey in October 2004. However, they never obtained a marriage license. Sam died in March 2018, survived by...

-

George Tanner died October 2, 2017, survived by his son Thomas and his daughter Gigi Tanner Stewart and her children, Sam and Cindy. George was the sole stockholder of Tanner, Inc., a C corporation....

-

Your firm has prepared the estate tax return (Form 706) for the Estate of Belinda Baker, a widow who died January 13, 2018. Besides substantial amounts of cash, mostly in certificates of deposit, she...

-

The benefit of the person-environment fit model is that it allows us to put housing options on an x-y axis comparing autonomy and competence. in terms of two conflicting forces: environmental press...

-

Problem 2: Pat and Chris Broderick have just purchased a home in Lincoln Park. The home's sale price was $549,000. As a veteran, Pat was able to get a 30-yr loan, with an APR of 3.75% compounded...

-

Summarize: The challenge of sustainability will impact the hospital health care setting significantly. Hospitals are high energy consumers due to their 24/7 operation. To become sustainable, they...

Study smarter with the SolutionInn App