P and S Corporations form in Year 1, with S as P's wholly-owned subsidiary. The corporations immediately

Question:

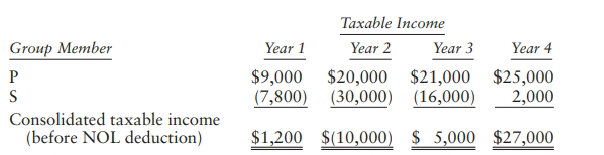

P and S Corporations form in Year 1, with S as P's wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results:

In what year(s) can the group deduct the Year 2 consolidated NOL? Assume that Year 2 is 2018 or a later year.

Transcribed Image Text:

Тахаble Incomе Group Member Year 1 Year 2 $9,000 $20,000 (7,800) (30,000) (16,000) Year 4 Year 3 $21,000 $25,000 2,000 Consolidated taxable income (before NOL deduction) $1,200 $(10,000) $ 5,000 $27,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

4000 in Year 3 and 6000 in Year 4 Because the NOL arose in 2018 o...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted:

Students also viewed these Business questions

-

Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 3, P sells...

-

Alice, a married taxpayer, will form Morning Corporation in the current year. Alice plans to acquire all of Morning's common stock for a $1 mill ion contribution to the corporation. Morning will...

-

Refer to the facts of Problem C: 12-36 and assume the current year is 2018. Emily's prior gifts are as follows: Year . . . . . . . . . . . . . . . . . . . . Amount of Taxable Gifts 1974 . . . . . . ....

-

The CFO of the Jordan Microscope Corporation intentionally misclassified a downstream transportation expense in the amount of $575,000 as a product cost in an accounting period when the company made...

-

Find the acute angle between the planes 2x - 4y + z = 7 and 3x + 2y - 5z = 9.

-

A common punishment for school children is to write out a sentence multiple times. Write a Python stand-alone program that will write out the following sentence one hundred times: I will never spam...

-

Purina entered in a contract with the defendant to sell the defendant piglets, known as weanlingsbaby pigs that have been weaned. It is uncontested that the buyer breached and that Purina is entitled...

-

At December 31, 2013, Crawford Company had a balance of $15,000 in Allowance for Doubtful Accounts. During 2014, Crawford wrote off accounts totaling $14,100. One of those accounts ($1,800) was later...

-

Ricardo works for Bank B and is talking about loans with a consumer. He provides the consumer with a general explanation regarding the basic qualifications of a loan. Although the consumer plans to...

-

What can you conclude about the ratio of fugacity to pressure for N 2 ,H 2 , and NH 3 at 500 bar using the data in Figure 7.10? Figure 7.10 1.5 H2, 1.4 N2 1.3 1.2 1.1 1.0 100 200 300 400 500 600 700...

-

Peoria and Salem Corporations have filed consolidated tax returns for several years. For the current year, consolidated taxable income is $300,000. The consolidated general business credit (computed...

-

P Corporation owns 100% of S Corporation's stock, and S owns 100% of T Corporation's stock. The three corporations have filed consolidated tax returns for several years. On January 1 of the current...

-

What does a work need to acquire copyright protection in the United States?

-

You are given information on two stocks. Stock AXE has a required return of 12.25% and analysts expected the stock to provide a return of 13%. The beta of AXE stock is 1.15. Stock NIP has a beta of...

-

Consider the sorting algorithm given by the pseudocode below. It takes an array A[1..n] of size n, and outputs A with its elements in sorted (non-decreasing) order. 1 for i = 2 to n 2 j=i-1 234 NO 5...

-

Explain one positive and one negative aspect of the lifetime term of office for judges and justices in the federal court system. Why do you believe the constitution framers chose lifetime terms?

-

At a party a cooler is filled with cans of drinks: 12 cokes, 6diet cokes, 4 lime seltzers, and 8 lemon seltzers. You grab a canfrom the cooler at random. a) What is the probability that you grabbed...

-

Please do help me wuth taxation thank you Decedent is a citizen of the Philippines and a resident of Quezon City, died leaving the following: Rest house in Batangas inherited from his father during...

-

Relative to the distance of an object in front of a plane mirror, how far behind the mirror is the image?

-

U.S. households have become smaller over the years. The following table from the 2010 GSS contains information on the number of people currently aged 18 years or older living in a respondent's...

-

Discuss several ways in which physical goods are different from pure services. Give an example of a good and then an example of a service that illustrates each of the differences.

-

What products are being offered by a shop that specializes in bicycles? By a travel agent? By a supermarket? By a new car dealer?

-

Identify the determining dimension or dimensions that explain why you bought the specific brand you did in your most recent purchase of a ( a ) soft drink, ( b ) shampoo, ( c ) shirt or blouse, and (...

-

Brief Information: Internal auditors play a crucial role in supporting managerial decision-making within organizations. Their primary responsibility is to provide independent and objective...

-

Scott is a forensic accountant at a large professional services firm. He is working on an engagement at a client site and is looking at the data file containing dollar amounts on 10,000 invoices that...

-

The objective of the assignment is exposing the students to new sustainable technologies ( products , processes , software, etc. ) and the Life Cycle Analysis of Such technologies. The students will...

Study smarter with the SolutionInn App