Refer to the facts in Comprehensive Problem C:6-54. Now assume the entity is a partnership named Lifecycle

Question:

Refer to the facts in Comprehensive Problem C:6-54. Now assume the entity is a partnership named Lifecycle Partnership. Additional facts are as follows:

• Except for precontribution gains and losses, the partners agree to share profits and losses in a 60% (Able)-40% (Baker) ratio.

• The partners actively and materially participate in the partnership's business. Thus, the partnership is not a passive activity.

• Partnership debt is recourse debt.

• The salary to Able is a guaranteed payment.

• The E&P numbers are not relevant to the partnership.

• In addition to the numbers provided for the assets on January 2, 2021, the following partnership book values apply:

Equipment . . . . . . . . . . . . . . . . . . $ 215,000

Building . . . . . . . . . . . . . . . . . . . . . 926,000

Land A. . . . . . . . . . . . . . . . . . . . . . . . 30,000

Land B . . . . . . . . . . . . . . . . . . . . . . . .20,000

Total . . . . . . . . . . . . . . . . . . . . . . . . .$1,191,000

• On January 2, 2021, the partnership sells its assets and pays off the $1.87 million debt. The partnership then makes liquidating distributions of the $490,000 remaining cash to Able and Baker in accordance with their book capital account balances.

Required:

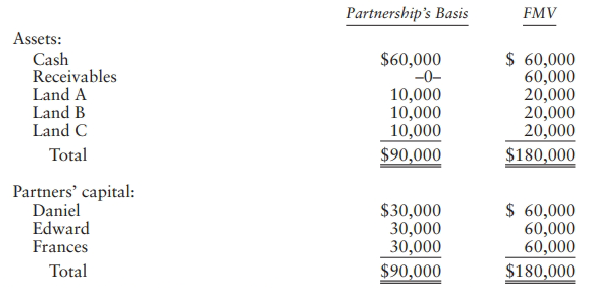

a. Determine the tax consequences of the partnership formation to Able, Baker, and Lifecycle Partnership.

b. For 2018 through 2020, prepare a schedule showing:

(1) Partnership ordinary income and other separately stated items

(2) Able's and Baker's book capital accounts at the end of 2018, 2019, and 2020

(3) Able's and Baker's bases in their partnership interests at the end of 2018, 2019, and 2020

c. For 2021, determine:

(1) The results of the asset sales

(2) Able's and Baker's book capital accounts after the asset sales but before the final liquidating distribution

(3) Able's and Baker's bases in their partnership interests after the asset sales but before the final liquidating distribution

(4) The results of the liquidating distributions, assuming a 23.8% tax rate (the 20% maximum capital gain rate plus the 3.8% rate on net investment income)

Data from C: 10-54:

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf