Stephen R. and Rachel K. Bates, both U.S . citizens, resided in Country K for the entire

Question:

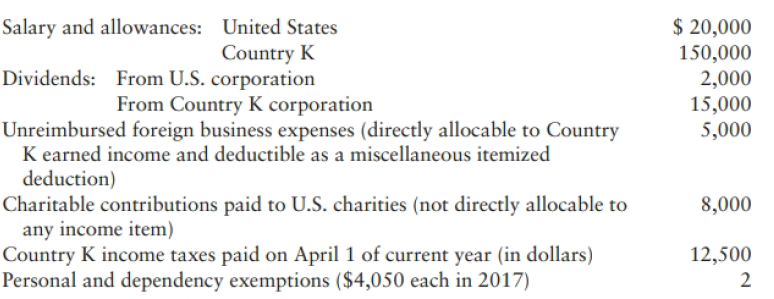

Stephen R. and Rachel K. Bates, both U.S . citizens, resided in Country K for the entire current year except when Stephen was temporarily assigned to his employer's home office in the United States. They file a joint return and use the calendar year as their tax year. The Bateses report the following current-year income and expense items:

Last year, the Bateses elected to accrue their foreign income taxes for foreign tax credit purposes. No foreign tax credit carryovers to the current year are available. Stephen Bates estimates the family will owe 75,000 tesos in Country K income taxes for this year on the Country K salary and dividends. The average annual exchange rate for the current year is 4 tesos to $1 (U.S.). The teso-U.S. dollar exchange rate did not change between year-end and the date the Bates paid their Country K taxes. No Country K taxes were withheld on the foreign corporation dividend.

Complete the two Form 1116s the Bateses must file with their income tax return to claim a credit for the foreign taxes paid on the salary and dividends. Use 2017 tax forms and ignore the implications of the Sec. 911 earned income exclusion, itemized deduction and personal exemption phase-outs, and alternative minimum tax provisions.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf