The diagram below shows the competitive market for gasoline in two island economies, Island Flatland and Island

Question:

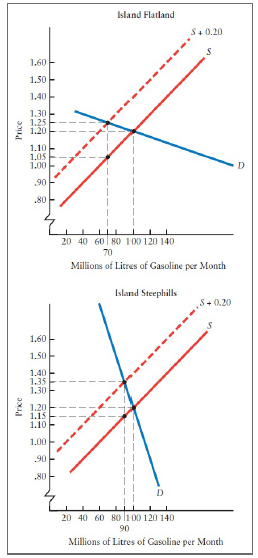

The diagram below shows the competitive market for gasoline in two island economies, Island Flatland and Island Steephills, which have similar populations but have different elasticities of demand for the product. On each island a tax of $0.20 per litre of gasoline is imposed.

a. What is the producers? net revenue before imposition of the tax on each island (in dollars)? What is their net?revenue after imposition of the tax?

b. What is the direct burden of this tax on each island?

c. What is the excess burden of the tax on each island?

d. Is the tax more allocatively efficient on one island than another? How do you explain this?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: