Allen Company acquired 100 percent of Bradford Companys voting stock on January 1, 2017, by issuing 10,000

Question:

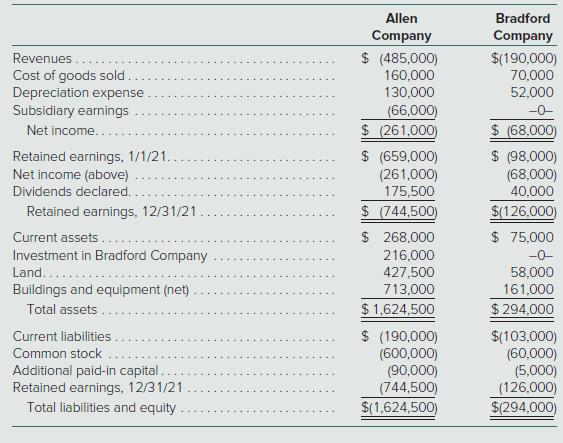

Allen Company acquired 100 percent of Bradford Company’s voting stock on January 1, 2017, by issuing 10,000 shares of its $10 par value common stock (having a fair value of $14 per share). As of that date, Bradford had stockholders’ equity totaling $105,000. Land shown on Bradford’s accounting records was undervalued by $10,000. Equipment (with a five-year remaining life) was undervalued by $5,000. A secret formula developed by Bradford was appraised at $20,000 with an estimated life of 20 years. The following are the separate financial statements for the two companies for the year ending December 31, 2021. There were no intra-entity payables on that date. Credit balances are indicated by parentheses.

a. Explain how Allen derived the $66,000 balance in the Subsidiary Earnings account.

b. Prepare a worksheet to consolidate the financial information for these two companies.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik