Assume that Chapman Company acquired Abernethys common stock by paying $520,000 in cash. All of Abernethys accounts

Question:

Assume that Chapman Company acquired Abernethy’s common stock by paying $520,000 in cash. All of Abernethy’s accounts are estimated to have a fair value approximately equal to present book values. Chapman uses the partial equity method to account for its investment. Prepare the consolidation worksheet entries for December 31, 2020, and December 31, 2021.

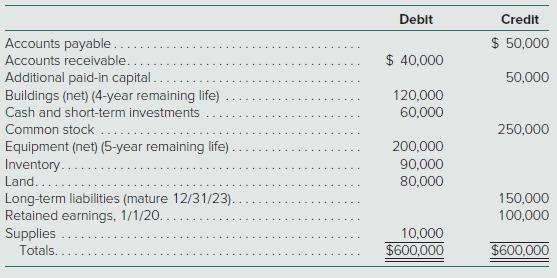

Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that date, Abernethy has the following trial balance:

During 2020, Abernethy reported net income of $80,000 while declaring and paying dividends of $10,000. During 2021, Abernethy reported net income of $110,000 while declaring and paying dividends of $30,000.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik