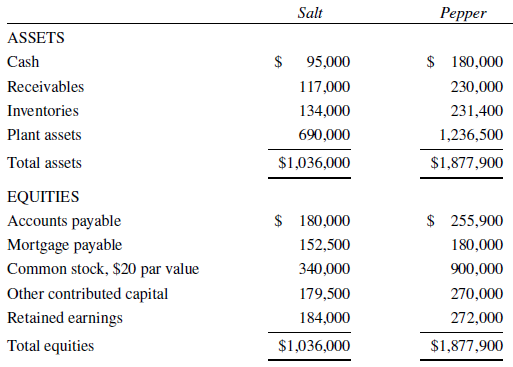

Balance sheets for Salt Company and Pepper Company on December 31, 2018, follow: Pepper Company tentatively plans

Question:

Balance sheets for Salt Company and Pepper Company on December 31, 2018, follow:

Pepper Company tentatively plans to issue 30,000 shares of its $20 par value stock, which has a current market value of $37 per share net of commissions and other issue costs. Pepper Company then plans to acquire the assets and assume the liabilities of Salt Company for a cash payment of $800,000 and $300,000 in long-term 8% notes payable. Pepper Company?s receivables include $60,000 owed by Salt Company. Pepper Company is willing to pay more than the book value of Salt Company assets because plant assets are undervalued by $215,000 and Salt Company has historically earned above-normal profits.

Required:

Prepare a pro forma balance sheet showing the effects of these planned transactions.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: