It is January 20, Year 13. Mr. Neely, a partner in your office, wants to see you,

Question:

It is January 20, Year 13. Mr. Neely, a partner in your office, wants to see you, CPA, about Bruin Car Parts Inc. (BCP), a client req_uiring assistance. BCP prepares its financial statements in accordance with ASPE. Richard (Rick) Bergeron, Lyle Chara, and Jean Perron each own 100 common shares of BCP. Jean wants BCP to buy him out. You made some notes on BCP during your discussion with Mr. Neely (Exhibit 1).

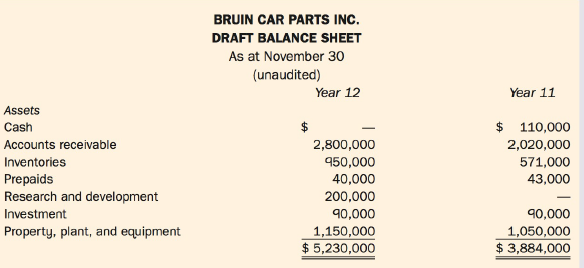

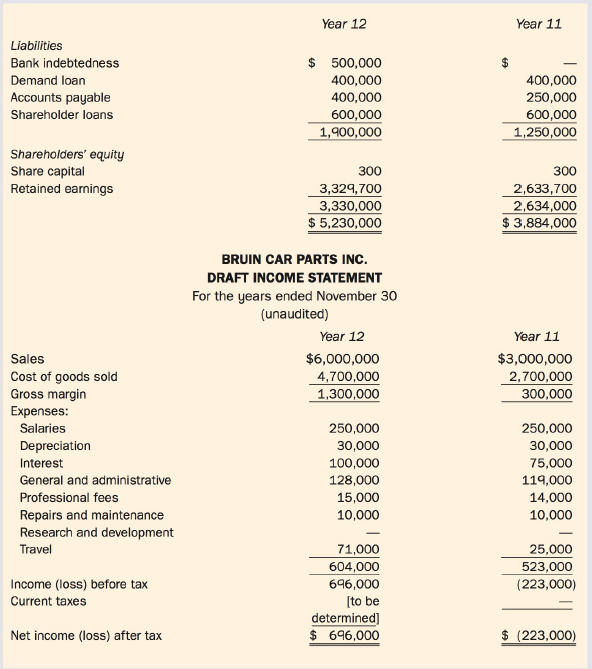

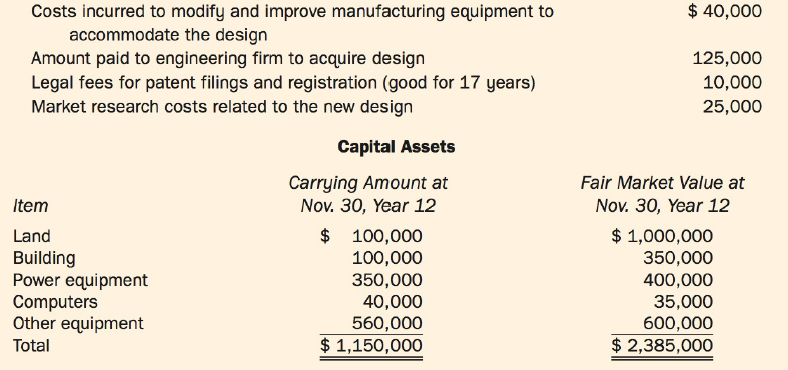

Mr. Neely forwarded an email from Rick (Exhibit II) to you, along with excerpts from the Signed Shareholders' Agreement (SSA) (Exhibit III), the draft financial statements for BCP for the year ended November 30, Year 12 (Exhibit IV), and some additional information regarding the draft financial statements (Exhibit V).

Mr. Neely tells you, "CPA, we need to establish a buyout value. Our valuation must take into account any accounting adjustments required to comply with the SSA requirements. Please also consider any other issues that may be relevant to the other shareholders."

Exhibit I:

NOTES ON BRUIN CAR PARTS INC.

BCP was founded 30 years ago. It manufactures car parts for the North American automotive industry. All sales are made to Canadian-based companies.

All three shareholders have known each other for over 35 years and have different roles within BCP. Rick handles the financial and administrative duties, Lyle is in charge of product design and testing, and Jean is in charge of sales.

BCP's corporate tax rate is the small business rate of 12% for active business income. BCP applies the taxes payable method for accounting purposes. BCP incurred operating losses in the last few years and as a result has accumulated non-capital losses totalling $240,000, which can be applied against taxable income and thereby save taxes in future years.

BCP does research and development (R&D) every five years, on average. When it does, it is able to claim a 35% investment tax credit on its eligible R&D costs.

Exhibit II:

EMAIL FROM MR. BERGERON:

Jean Perron told us on January 12 that he wants to be bought out of BCP. This request has shocked Lyle and me. He said that BCP must buy him out, as per the SSA. I knew Jean was having personal difficulties after his divorce, and he took time off, but he seemed better lately. He started asking for a repayment of his shareholder loan a few months ago to help with his cash flow, but we could not afford it. We were planning to repay him soon, since Year 12 was our best year in the past five years.

We need you to determine the impact of the buyout on BCP. I pulled out the SSA from our archived corporate files. It took me a while to find it, and I barely remembered what it said.

Exhibit III:

EXCERPTS FROM BCP'S SIGNED SHAREHOLDERS' AGREEMENT

Between: Mr. Richard Bergeron, Mr. Ly le Chara, and Mr. Jean Perron ("the Shareholders") and Bruin Car Parts Inc. ("BCP")

Clause 3:

Any of the Shareholders may give notice, within qo days after the end of the fiscal year, of the intent to sell their shares.

Effective the date the notice is given, the seller's shares will be exchanged for non-voting preferred shares, which BCP must then redeem. BCP shall redeem 10% of the shares with in sixty (60) days of receiving notice. The rest of the shares will be redeemed over nine (q) years on an eq,ual annual basis, with the first redemption one year after the initial payment.

To determine the value of the shares for redemption purposes, the starting point will be the shareholders' equity on BCP's balance sheet, prepared in accordance with Canadian generally accepted accounting principles, as at the latest fiscal year-end, with adjustments made to recognize the following factors:

• All capital assets and investments shall be at their fair market value.

• The va lue of the shares of BCP shall include a liability for current taxes for the latest fiscal year end.

• Any goodwill shall not have any value.

• Any non-capital losses shall be valued using the tax rate applicable at the date of the notice of redemption.

• Each share shall be valued at a pro rata portion of the total value of the company.

The following discount should be applied to the value of each share if the redemption occurs during the period referred to:

• Prior to the fifth anniversary of the SSA: 50%

• Prior to the tenth ann iversary of the SSA: 25%

• After the tenth anniversary of the SSA: 10%

Upon notice of redemption, any balance due to the shareholder becomes payable on the same terms as for the redemption of the shares.

Exhibit IV:

Exhibit V:

ADDITIONAL INFORMATION FROM RICK

REGARDING BCP'S DRAFT FINANCIAL STATEMENTS

This year was much better due to advances in our product design and increased sales efforts. We gained efficiencies in our production processes, so our gross margins were also much better. The notes below explain some of the variances in the draft financials.

Accounts Receivable

Higher due to increased sales generated this year. Jean spent a lot more time travelling to conventions and made many visits to new and existing clients, all of which appears to have paid off based on the sales he generated. I wish we would get paid, though. Some of the sales Jean generated have been outstanding since the summer or earlier. A receivable of about $500,000 is due from one of the clients Jean brought in. Jean told us he visited their plant and they have a great operation. He figures it is a matter of time and cash flow management, but I am skeptical. The mailing address appears to be a warehouse in downtown Saskatoon. I phoned the number on file, and a recording said it was out of service. Jean is still confident they will pay us. Yesterday, he brought in a cheque from them for $100,000.

Inventory:

Inventory is carried at cost. However, due to recent legislative changes, about $200,000 of parts inventory may be obsolete. Jean has identified a client that is willing to buy the parts at cost, so we left the inventory on the books at year end. I am beginning to wonder about this deal, though. I have asked some of our other clients if they would purchase the parts, and they rep lied that they believed the new legislation would prohibit it. Besides these parts, the retail price of our inventory is about 20% higher than what we show on the books. In June, a customer placed a special order that we stored off-site once completed. These parts were still in storage at year-end, and we therefore capitalized the $15,000 storage costs to inventory.

Investment:

The investment represents a 5% interest in shares of a company . The shares are not traded on the open market. There is a rumour that the company is once again involved in some lawsuits, and we are not sure if it is going to survive much longer. We have decided to sell our interest next week, based on an offer of $30,000 we received from a private investment firm . Gains or losses on investments are taxable/deductible for tax purposes in the year of the sale.

Research and Development:

Costs of $200,000 have been capitalized. We do R&D every five years, on average, since that is the average amount of time before a part becomes obsolete. This past year we were approached by an engineering firm that proposed a new design to us. Prior to purchasing this design we incurred costs, including some market research costs to ensure that it would generate additional sales. Subsequent to the purchase we asked our lawyers to patent the design so we could use it for the foreseeable future. All this work appears to be paying off as our sales have gone up. We expect to file an investment tax credit cla im for the maximum amount of eligible expenditures.

Included in R&D costs are the following items:

The original cost of the building was $200,000. The fair market value of all other depreciable property is less than the original cost. Only 50% of the excess of fair market value over original cost is taxable for tax purposes in the year of the sale. The maximum capital cost allowance (CCA) that could be claimed for tax purposes in Year 12 is $201,268.

Other:

Short-term liabilities increased to help finance production of inventories while waiting for payment from customers on account.

Shareholder loans are split equally between the three of us. Interest expense includes late filing HST/GST interest and penalties of $1,500, which is not deductible for tax purposes.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell