Kings Road recently acquired all of Oxford Corporations stock and is now consolidating the financial data of

Question:

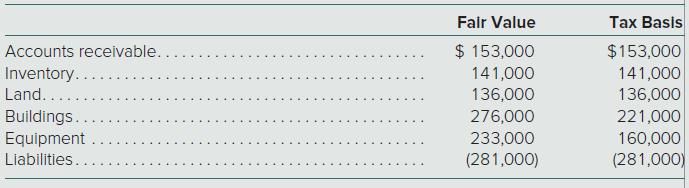

King’s Road recently acquired all of Oxford Corporation’s stock and is now consolidating the financial data of this new subsidiary. King’s Road paid a total of $850,000 for Oxford, which has the following accounts:

a. What amount of deferred tax liability arises in the acquisition?

b. What amounts will be used to consolidate Oxford with King’s Road at the date of acquisition?

c. On a consolidated balance sheet prepared immediately after this takeover, how much goodwill should King’s Road recognize? Assume a 21 percent effective tax rate.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Question Posted: