On January 1, Year 6, HD Ltd., a building supply company, JC Ltd., a construction company, and

Question:

On January 1, Year 6, HD Ltd., a building supply company, JC Ltd., a construction company, and Mr. Saeid, a private investor, signed an agreement to carry out a joint operation under the following terms and conditions:

• JC would buy and renovate homes on behalf of the three parties to the joint operation in addition to its other construction activities. It would arrange a first mortgage on the property when purchasing the home.

• HD would supply all of the construction materials at a reduced markup from its regular sales.

• Mr. Saeid would guarantee the payment of the mortgage and would lend money to JC for the down payment on the purchase of the property and to finance the cost of materials and labour during the renovation. The loans would be interest free with no monthly payments and would be repayable out of the proceeds on sale of the property.

• All three parties would have a one-third interest in the properties under renovation and cash for joint properties, would be responsible for one-third of the mortgage payable and loan payable to Mr. Saeid and would receive one-third of the profit from sale of the renovated properties.

• JD would pay the other two joint operators their share of the profit on each property within 30 days of the closing date for the sale of the property.

• All three parties must agree on major operating and financing decisions with respect to joint operations of the renovated houses.

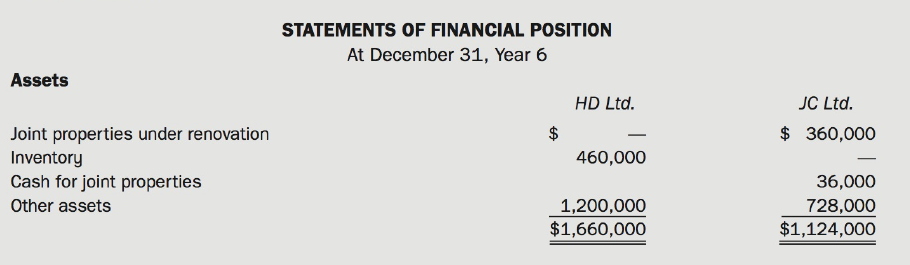

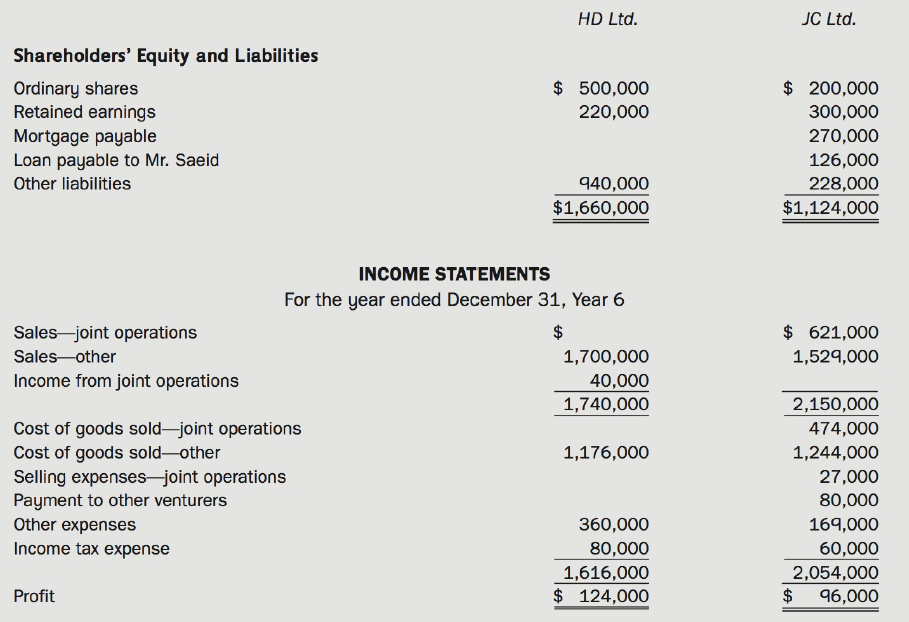

Condensed financial statements for HD Ltd. and JC Ltd. for the year ended December 31, Year 6, were as follows:

Additional information:

• During Year 6, HD had sales of $102,000 to JC at a markup of 20 percent of selling price. On December 31, Year 6, the property under renovation included supplies purchased from JC of $30,000.

• HD reports its share of income from the joint operations when it is received from JC.

• Both companies pay income tax at a rate of 40% on taxable income.

Required:

Prepare corrected Year 6 financial statements for HD in accordance with IFRS 11.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell