On June 30, 2020, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10

Question:

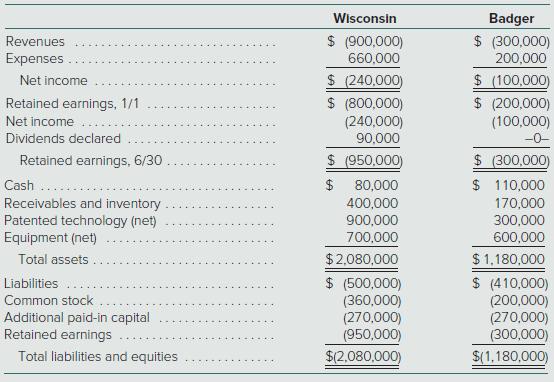

On June 30, 2020, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior to the combination, the financial statements for Wisconsin and Badger for the six-month period ending June 30, 2020, were as follows (credit balances in parentheses):

Wisconsin also paid $30,000 to a broker for arranging the transaction. In addition, Wisconsin paid $40,000 in stock issuance costs. Badger’s equipment was actually worth $700,000, but its patented technology was valued at only $280,000.

What are the consolidated balances for the following accounts?

a. Net income

b. Retained earnings, 1/1/20

c. Patented technology

d. Goodwill

e. Liabilities

f. Common stock

g. Additional paid-in capital

Wisconsin $ (900,000) 660,000 Badger $ (300,000) 200,000 Revenues Expenses $ (240,000) $ (800,000) (240,000) 90,000 $ (100,000) $ (200,000) (100,000) Net income Retained earnings, 1/1 Net income Dividends declared -0- $ (300,000) $ 110,000 170,000 Retained earnings, 6/30 $ (950,000) Cash Receivables and inventory Patented technology (net) Equipment (net) $ 80,000 400,000 900,000 300,000 700,000 600,000 $2,080,000 $ (500,000) (360,000) (270,000) (950,000) $(2,080,000) $ 1,180,000 $ (410,000) (200,000) (270,000) (300,000) Total assets . Liabilities Common stock Additional paid-in capital Retained earnings Total liabilities and equities $(1,180,000)

Step by Step Answer:

Under the acquisition method the shares issued by Wisconsin are recorded at fair value using the fol...View the full answer

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Students also viewed these Business questions

-

On June 30, 2011, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company....

-

On June 30, 2015, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company....

-

On June 30, 2013, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company....

-

In a recent survey, 80% of the community favored building a police substation in their neighborhood. If 20 citizens are chosen, what is the mean and standard deviation for the number favoring the...

-

Predict the molecular geometry of each of the following molecules: (a). (b). (c). H-N- N-H

-

Hypergeometric simulation in Sect. 3.3.5 implies a symmetric null distribution with standard deviation 0.23 for the weighted sample correlation of homogamic pairs. One suggested alternative to random...

-

What limits the lifetime of a battery?

-

Reliance Company manufactures and sells wireless video cell phones, which it guarantees for five years. If a cell phone fails, it is replaced free, but the customer is charged a service fee for...

-

Draw energy band diagram for a MOS structure in thermal equilibrium with (a). P-type semiconductor. Use4 , 3.5 , 1.0m sc Gq eV q eV E eV = = = and calculate VFB. Estimate the required applied voltage...

-

On December 31, 2020, GameStop closed at $18.84. By the end of January 2021, the stock closed at an astronomically high $325, for an astounding one-month return of 1625%! A week later, the price was...

-

In the December 31, 2020, consolidated balance sheet of Patrick and its subsidiary, what amount of total stockholders equity should be reported? a. $1,100,000 b. $1,125,000 c. $1,150,000 d....

-

On January 1, 2021, Casey Corporation exchanged $3,300,000 cash for 100 percent of the outstanding voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary...

-

Explain the difference between simple and complex elements.

-

Make an APA Title Page with Running head Make a Thesis Statement as your first paragraph .(Three main ideas minimum. Each point must be a sentence in length ) Make the "Body" of your paper based upon...

-

Emily owns three businesses: a dry cleaner, a market, and a candy store. The dry cleaner has revenue of $5,000, the market has revenue of $10,000, and the candy store has revenue of $7,000. Under the...

-

In a short essay, discuss the difference between efficiency and effectiveness. Include specific examples to support each concept. In a short essay, differentiate between the symbolic view and the...

-

On a log scale: if 10 is one inch away from 100, how far is 10,000 from 100? How far would they be apart on a linear scale?

-

Objective: Working with control statements, iteration structures, data structures & functions Create one .py source file. Tasks Task 1 (30 marks) You are going to create an application that allows a...

-

In Exercise 59, consider the following additional information on credit card usage: 70% of all regular fill-up customers use a credit card. 50% of all regular non-fill-up customers use a credit card....

-

A sample statistic will not change from sample to sample. Determine whether the statement is true or false. If it is false, rewrite it as a true statement.

-

Several years ago Brant, Inc., sold $900,000 in bonds to the public. Annual cash interest of 9 percent ($81,000) was to be paid on this debt. The bonds were issued at a discount to yield 12 percent....

-

Garfun, Inc., owns all of the stock of Simon, Inc. For 2014, Garfun reports income (exclusive of any investment income) of $480,000. Garfun has 80,000 shares of common stock outstanding. It also has...

-

The following separate income statements are for Burks Company and its 80 percentowned subsidiary, Foreman Company: Additional Information Amortization expense resulting from Foremans excess...

-

What effect does an antagonist drug have over the receptors ?

-

Read this article on the differences and Comparisons between UNIX and LINUX http://www.diffen.com/difference/Linux_vs_Unix, then do some research and post your thoughts on each of the systems. Based...

-

Assume that in 2023, Bobby had a vacant lot that was given to him as a gift from his father that had an FMV of $40,000 and an adjusted basis of $15,000.

Study smarter with the SolutionInn App