Purchase Company recently acquired several businesses and recognized goodwill in each acquisition. Purchase has allocated the resulting

Question:

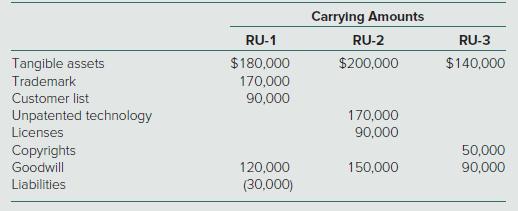

Purchase Company recently acquired several businesses and recognized goodwill in each acquisition. Purchase has allocated the resulting goodwill to its three reporting units: RU-1, RU-2, and RU-3. Purchase opts to skip the qualitative assessment and therefore performs a quantitative goodwill impairment review annually. In its current-year assessment of goodwill, Purchase provides the following individual asset and liability carrying amounts for each of its reporting units:

The total fair values for each reporting unit (including goodwill) are $510,000 for RU-1, $580,000 for RU-2, and $560,000 for RU-3. To date, Purchase has reported no goodwill impairments. How much goodwill impairment should Purchase report this year for each of its reporting units?

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik