Select the best answer for each of the following. 1. A forward contract is a hedge of

Question:

Select the best answer for each of the following.

1. A forward contract is a hedge of an identifiable foreign currency commitment if

(a) The forward contract is designated as, and is effective as, a hedge of a foreign currency commitment.

(b) The foreign currency commitment is firm.

(c) The amount of the forward contract is equal to the amount of the commitment.

(d) Both (a) and (b).

(e) Both (a) and (c).

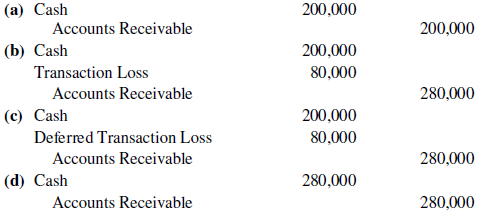

2. The Carnival Company has a receivable from a foreign customer that is payable in the local currency of the foreign customer. The account receivable for 800,000 local currency units (LCU) has been translated into $280,000 on Carnival?s December 31, 2019, balance sheet. On January 15, 2020, the receivable was collected in full when the exchange rate was 4 LCU to $1. What journal entry should Carnival make to record the collection of this receivable?

3. A foreign currency transaction to a company domiciled in the United States is a transaction in which the amount is

(a) Measured in a foreign currency.

(b) Denominated in U.S. dollars.

(c) Denominated in a foreign currency.

(d) Measured in U.S. dollars.

4. A direct exchange quotation is one in which the exchange rate is quoted

(a) In terms of how many units of the domestic currency can be converted into one unit of foreign currency.

(b) In terms of how many units of the foreign currency can be converted into one unit of the domestic currency.

(c) For the future delivery of currencies exchanged.

(d) For the immediate delivery of currencies exchanged.

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer: