Smith Corporation has gone through bankruptcy and is ready to emerge as a reorganized entity on December

Question:

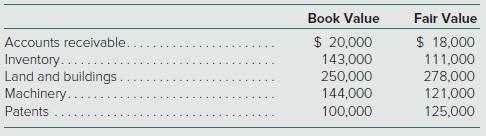

Smith Corporation has gone through bankruptcy and is ready to emerge as a reorganized entity on December 31, 2020. On this date, the company has the following assets (fair value is based on discounting the anticipated future cash flows):

The company has a reorganization value of $800,000.

Smith has 50,000 shares of $10 par value common stock outstanding. A deficit retained earnings balance of $670,000 also is reported. The owners will distribute 30,000 shares of this stock as part of the reorganization plan.

The company’s liabilities will be settled as follows:

- Accounts payable of $180,000 (existing at the date on which the order for relief was granted) will be settled with an 8 percent, two-year note for $35,000.

- Accounts payable of $97,000 (incurred since the date on which the order for relief was granted) will be paid in the regular course of business.

- Note payable—First Metropolitan Bank of $200,000 will be settled with an 8 percent, five-year note for $50,000 and 15,000 shares of the stock contributed by the owners.

- Note payable—Northwestern Bank of Tulsa of $350,000 will be settled with a 7 percent, eight-year note for $100,000 and 15,000 shares of the stock contributed by the owners.

a. How does Smith Corporation’s accountant know that fresh start accounting must be utilized?

b. Prepare a balance sheet for Smith Corporation upon its emergence from reorganization.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik