Spalding Company has offered to sell to Ping Company its assets at their book values plus $1,800,000

Question:

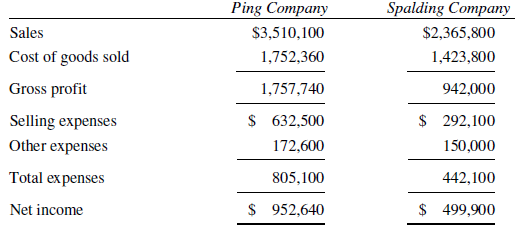

Spalding Company has offered to sell to Ping Company its assets at their book values plus $1,800,000 representing payment for goodwill. Operating data for 2018 for the two companies are as follows:

Ping Company?s management estimates the following operating changes if Spalding Company is merged with Ping Company through a purchase:

A. After the merger, the sales volume of Ping Company will be 20% in excess of the present combined sales volume, and the sale price per unit will be decreased by 10%.

B. Fixed manufacturing expenses have been 35% of cost of goods sold for each company. After the merger the fixed manufacturing expenses of Ping Company will be increased by 70% of the current fixed manufacturing expenses of Spalding Company. The current variable manufacturing expenses of Ping Company, which is 70% of cost of goods sold, is expected to increase in proportion to the increase in sales volume.

C. Selling expenses of Ping Company are expected to be 85% of the present combined selling expenses of the two companies.

D. Other expenses of Ping Company are expected to increase by 85% as a result of the merger. Any excess of the estimated net income of the merged company over the combined present net income of the two companies is to be capitalized at 20%. If this amount exceeds the price set by Spalding Company for goodwill, Ping Company will accept the offer.

Required:

Prepare a pro forma (or projected) income statement for Ping Company for 2019 assuming the merger takes place, and indicate whether Ping Company should accept the offer.

Step by Step Answer: