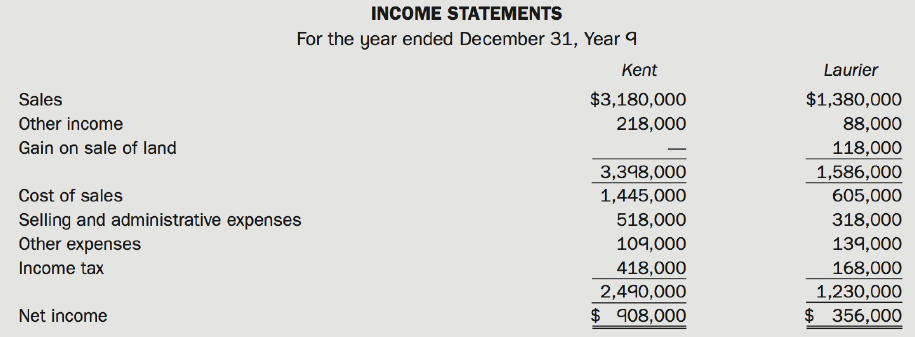

The following are the Year 9 income statements of Kent Corp. and Laurier Enterprises. Additional Information:

Question:

The following are the Year 9 income statements of Kent Corp. and Laurier Enterprises.

Additional Information:

• Kent acquired its 40% interest in the common shares of Laurier in Year 3 at a cost of $843,000 and uses the cost method to account for its investment for internal record keeping.

• The acquisition differential amortization schedule pertaining to Kent's 40% interest showed the following write-off for Year 9:

Buildings $18,000

Goodwill impairment loss 22,000

40,000

Long-term liabilities 21,500

Acquisition-differential amortization and impairment-Year q $18,500

• Depreciation expense and goodwill impairment loss are included with selling and administrative expenses.

• In Year 9, rent amounting to $30,000 was paid by Laurier to Kent. Kent has recorded this as other income.

• In Year 6, Kent sold land to Laurier and recorded a profit of $93,000 on the transaction. During Year 9, Laurier sold 30% of the land to an unrelated land development company.

• During Year 9, Laurier paid dividends totalling $107,000.

• It has been established that Kent's 40% interest would not be considered control in accordance withiFRS.

• Assume a 40% tax rate.

Required:

(a) Assume that Laurier is a joint venture that is owned by Kent and two other unrelated venturers. Also assume that Kent acquired its interest after Laurier's initial formation, and that the acquisition differentials are therefore valid. Prepare the income statement of Kent for Year 9 using the equity method. (Show all calculations.)

(b) Assume that Laurier is a joint operation. Prepare Kent's income statement for Year 9 using proportionately adjusted financial statements. (Show all calculations.)

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell