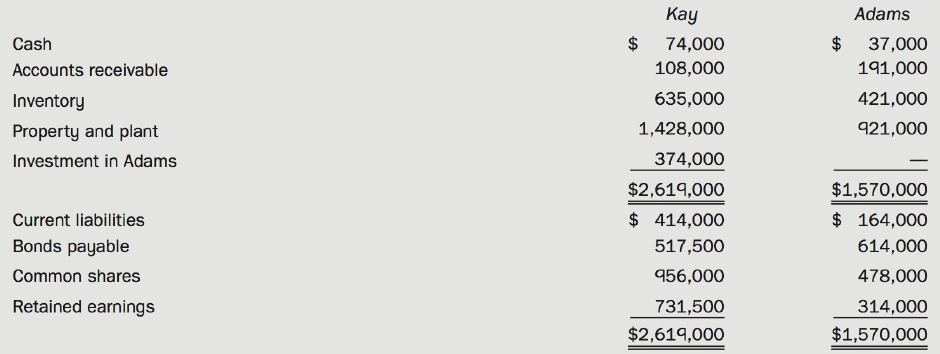

The following balance sheets have been prepared as at December 31, Year 6, for Kay Corp. and

Question:

The following balance sheets have been prepared as at December 31, Year 6, for Kay Corp. and Adams Ventures:

Additional Information:

• Kay acquired its 40% interest in Adams for $374,000 in Year 2, when Adams's retained earnings amounted to $184,000. The acquisition differential on that date was fully amortized by the end of Year6.

• In Year 5, Kay sold land to Adams and recorded a gain of $74,000 on the transaction. Adams is still using this land.

• The December 31, Year 6, inventory of Kay contained a profit recorded by Adams amounting to $49,000.

• On December 31, Year 6, Adams owes Kay $43,000.

• Kay has used the cost method to account for its investment in Adams.

• Use income tax allocation at a rate of 40%, but ignore income tax on the acquisition differential.

Required:

(a) Prepare three separate balance sheets for Kay as at December 31, Year 6, assuming that the investment in Adams is a

(i) control investment;

(ii) joint operation and is reported using proportionately adjusted financial statements, and

(iii) significant influence investment.

(b) Calculate the debt-to-equity ratio for each of the balance sheets in part (a). Which reporting method presents the strongest position from a solvency point of view? Briefly explain.

(c) Prepare the financial statements required for part (a) using the worksheet approach.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell