The general ledger trial balance of the General Fund of the City of Bedford on January 1,

Question:

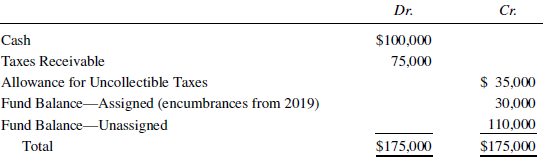

The general ledger trial balance of the General Fund of the City of Bedford on January 1, 2020, shows the following:

A summary of activities and transactions for the General Fund during 2020 is presented here:

1. The City Council adopted a budget for the General Fund with estimated revenues of $1,560,000 and authorization for appropriated expenditures of $1,400,000. The budget authorized the transfer of $50,000 from the Water Fund to the General Fund for operating expenses as a payment in lieu of taxes. Cash for the payment of interest due for the year on the $1,000,000, 8% bond issue for the Civic Center is approved for transfer from the General Fund to the Debt Service Fund.

2. The annual property tax levy of 10% on assessed valuation ($11,000,000) is billed to property owners. Two percent is estimated to be uncollectible.

3. Goods and services amounting to $1,150,000 were ordered during the year.

4. Invoices for all goods ordered in 2019 amounting to $29,000 were approved for payment.

5. Funds for bond interest on Civic Center bonds were transferred to the Debt Service Fund.

6. Invoices for goods and services received during the year totaling $1,155,000 were recorded. These were encumbered previously [see (3) above].

7. Transfer of funds from the Water Company was received in lieu of taxes.

8. Taxes were collected from property owners in the amount of $1,050,000.

9. Past-due tax bills of $17,000 were charged off as uncollectible.

10. Checks in payment of invoices for goods and services ordered in 2019 and 2020 were issued [see items (4) and (6) above].

11. Revenues received from miscellaneous sources, other than property taxes, of $455,000 were recorded.

12. Purchase order for two trash collection vehicle systems complete with residence trash containers for automatic pickup of trash was issued. Bid price per system was $120,000.?

Required:

A. Prepare journal entries to record the summary transactions. You may find it necessary or convenient to post journal entries to ledger t-accounts before the preparation of the required trial balances.

B. Prepare a preclosing trial balance.

C. Prepare closing entries.

D. Prepare a postclosing trial balance.

Step by Step Answer: