Question:

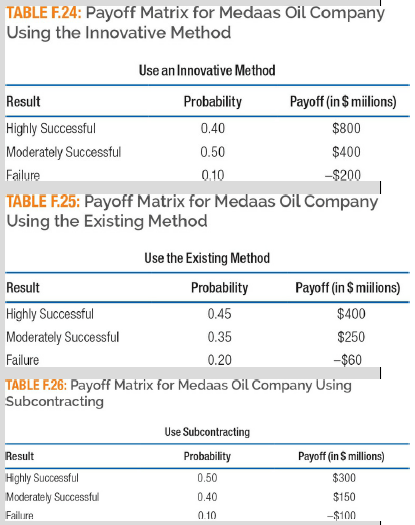

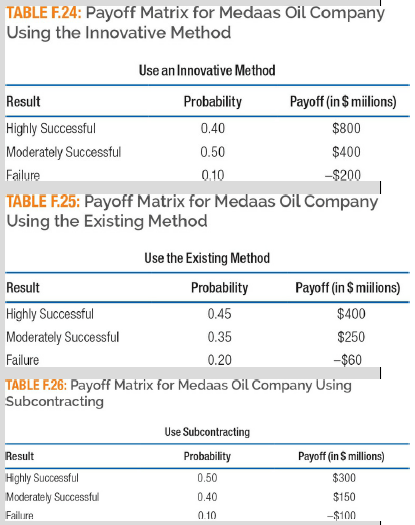

Medaas Oil Company located in Stavanger, Norway, is considering making a bid for an oil exploration contract to be awarded by the Norwegian government. Megan Medaas, the Chief Financial Officer of the company, has decided to a make a bid for $120 million. The cost of preparing the proposal for the bid is $3 million. The probability of winning the contract with this bid is 65%. If the company wins the contract, it can choose to use one of the three methods for extracting oil: use an innovative method, use the existing method, or subcontract. The probabilities of finding oil for each of the three methods with varying degrees of success are given in Tables F.24€“F.26.

Instead of bidding for the oil contract, Megan also has the option of partnering with another oil company in an alternative new venture. This option has a guaranteed payoff of $60 million. What should Megan do? Analyze the problem using a decision tree.

Transcribed Image Text:

TABLE F.24: Payoff Matrix for Medaas Oil Companý Using the Innovative Method Use an Innovative Method Payoff (in $ millions) Result Probability Highly Successful 0.40 $800 Moderately Successful 0.50 $400 -$200 Failure 0.10 TABLE F.25: Payoff Matrix for Medaas Õil Company Using the Existing Method Use the Existing Method Result Probability Payoff (in $ miilions) Highly Successful 0.45 $400 Moderately Successful 0.35 $250 -$60 Failure 0.20 TABLE F.26: Payoff Matrix for Medaas Õil Company Using Subcontracting Use Subcontracting Result Payoff (in $ millions) Probability Hghly Successful Moderately Successful 0.50 $300 0.40 $150 Failure 0.10 -$100