As the accountant for Monroe Trucking Company, you are preparing the companys annual return, Form 940 and

Question:

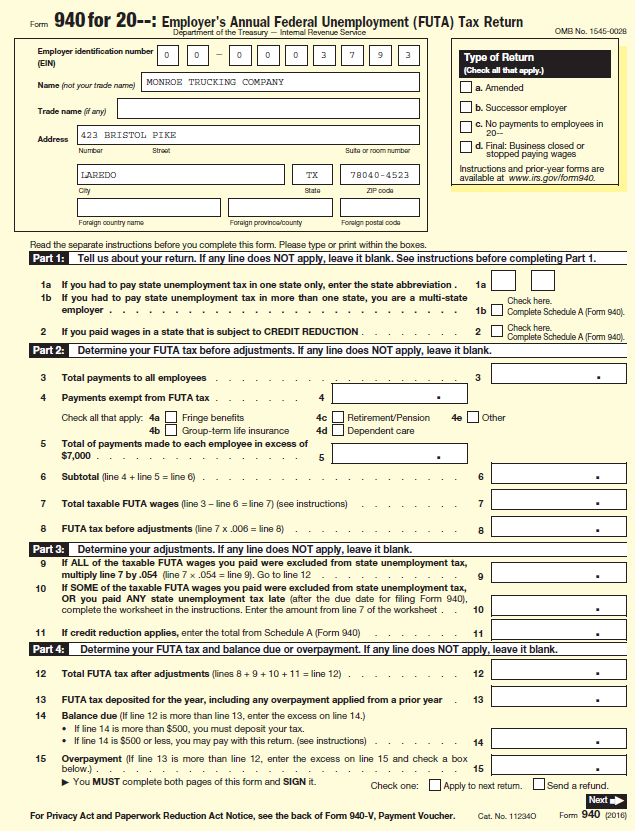

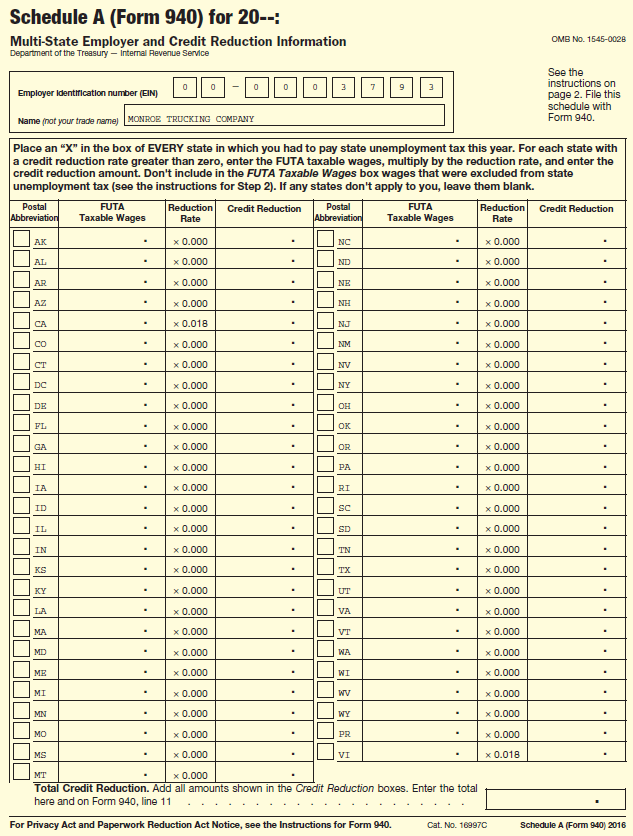

As the accountant for Monroe Trucking Company, you are preparing the company’s annual return, Form 940 and Schedule A. Use the following information to complete Form 940 and Schedule A on pages 5-52 to 5-54.

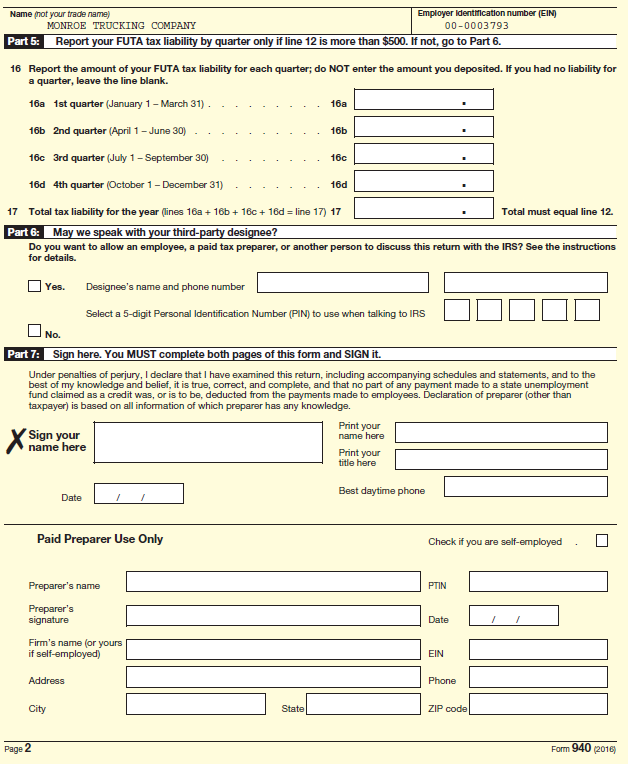

The net FUTA tax liability for each quarter of 2018 was as follows: 1st, $97.00; 2nd, $87.00; 3rd, $69.70; and 4th, $59.50.

Since the net FUTA tax liability did not exceed $500, the company was not required to make its first deposit of FUTA taxes until January 31, 2019. Assume that the electronic payment was made on time.

a. One of the employees performs all of his duties in another state—Louisiana.

b. Total payments made to employees during calendar year 2018:

Texas........................... $53,450

Louisiana.................... 22,150

Total........................... $75,600

c. Employer contributions into employees’ 401(k) retirement plan: $1,250.

d. Payments made to employees in excess of $7,000: $22,150.

e. Form is to be signed by Vernon Scott, Vice President.

f. Phone number—(834) 555-5551.

940 for 20--: Employer's Annual Federal Unemployment (FUTA) Tax Return Form Départment of the Treasury - Intemal Revenue Service OMB No. 1545-0028 Employer identification number Type of Return (EIN) (Cheok all that apply.) MONROE TRUCKING COMPANY Name (not your trade name) a. Amended b. Successor employer Trade name d any) c. No payments to employees in 20-- 423 BRISTOL PIKE Address d. Final: Business closed or stopped paying wages Suta or room number Number Stroet Instructions and prior-year forms are available at www.irs.gov/form940. LAREDO 78040-4523 City State ZIP coda Fordign country name Foraign province/bounty Foraign postal Doda Read the separate instructions before you complete this form. Please type or print within the boxes. Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1. 1a If you had to pay state unemployment tax in one state only, enter the state abbreviation. 1b If you had to pay state unemployment tax in more than one state, you are a multi-state employer. 1a Check here. 1b Complete Schedule A (Form 940). 2 If you paid wages in a state that is subject to CREDIT REDUCTION. Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. Check here. Complete Schedule A (Form 940). Total payments to all employees 3 4 Payments exempt from FUTA tax Check all that apply. 4a O Fringe benefits Retirement/Pension Other 4b Group-term life insurance 4d Dependent care Total of payments made to each employee in excess of $7,000 Subtotal (line 4 + line 5 = line 6) Total taxable FUTA wages (line 3- line 6 = line 7) (see instructions) FUTA tax before adjustments (line 7 x .006 = line 8) Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by .054 (line 7 x .054 = line 9). Go to line 12 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), 10 10 complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet. 11 If credit reduction applies, enter the total from Schedule A (Form 940) Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. Total FUTA tax after adjustments (lines 8 +9+ 10 +11 = line 12) . 12 12 13 FUTA tax deposited for the year, including any overpayment applied from a prior year 13 14 Balance due (If line 12 is more than line 13, enter the excess on line 14.) • If line 14 is more than $500, you must deposit your tax. • If line 14 is $500 or less, you may pay with this retum. (see instructions) 14 15 Overpayment (If line 13 is more than line 12, enter the excess on line 15 and check a box below.) You MUST complete both pages of this form and SIGN it. 15 U Apply to next retum. |Send a refund. Check one: Next Form 940 (2016) For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940-v, Payment Voucher. Cat. No. 112340 Name (not your trade name) Employer Identification number (EIN) MONROE TRUCKING COMPANY 00-0003793 Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6. 16 Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16a 1st quarter (January 1- March 31). 16a 16b 2nd quarter (April 1- June 30) 16b 16c 3rd quarter (July 1- September 30) 16c 16d 4th quarter (October 1- December 31) 16d 17 Total tax liability for the year (lines 16a + 16b + 16c + 16d = line 17) 17 Total must equal line 12. Part 6: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? Se the instructions for details. OYes. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS No. Part 7: Sign here. You MUST complete both pages of this form and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Print your name here Sign your name here Print your title here Best daytime phone Date Paid Preparer Use Only Check if you are self-employed Preparer's name PTIN Preparer's signature Date Firm's name yours if self-employed) EIN Address Phone City State ZIP code Page Form 940 (2016)

Step by Step Answer:

Form 940 Form 940 for 20 Employers Annual Federal Unemployment FUTA Tax Return Department of the Treasury Internal Revenue Service Employer identification number EIN Name not your trade name MONROE TR...View the full answer

Students also viewed these Business questions

-

The information listed below refers to the employees of Brennan Company for the year ended December 31, 2018. The wages are separated into the quarters in which they were paid to the individual...

-

Ernie Gilmore began working as a part-time waiter on June 1, 2018, at Sporthouse Restaurant. The cash tips of $390 that he received during June were reported on Form 4070, which he submitted to his...

-

The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2018 follow. a. Complete Schedule B of Form 941 on page 3-51 for the first...

-

Why does the following code fragment not have the same effect as the code fragment in the previous question? x.next t.next = t; = x.next;

-

(a) Determine the number of nonnegative integer solutions to the pair of equations x1 + x2 + x3 = 6. x1 + x2 + ... + x5 = 15. xi 0, 1 i 5. (b) Answer part (a) with the pair of equations replaced...

-

Give two examples of pricing decisions with a short-run focus.

-

Nereus Montemayor was an employee of VZ Hogs, a company that raises hogs and produces hog feed. VZ Hogs used an extruder manufactured by Sebright Products, Inc. to create hog feed out of discarded...

-

Dempsey Inc. is a retailer operating in British Columbia. Dempsey uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory...

-

A chimpanzee is swinging through the jungle on a 1 = 22.3 m-long vine, as shown. If the chimpanzee is to reach a tree branch h = 23.2 m above the horizontal jungle floor, what minimum speed must he...

-

The H & L Bark Company is considering the purchase of a debarking machine that is expected to provide cash flows as follows: If the appropriate annual discount rate is 14 percent, what is the present...

-

Applebaum Security Company is located in State H, which enables employers to reduce their contribution rates under the experience-rating system. From 2004 to 2013, inclusive, the companys total...

-

Carmen Santos is owner and sole employee of CS Corporation. He pays himself a salary of $2,400 this week. Additional tax information includes: FICA...

-

A lamp filament is made of tungsten. Why do we get a continuous spectrum rather than a tungsten line spectrum when light horn an incandescent lamp is viewed with a spectroscope?

-

Many feel that Small Businesses are at a significant disadvantage when competing with large national chains. Do you share this opinion? In what ways can a Small Business successfully compete with a...

-

1. Under traditional common law, in accepting an offer, may an offeree requestadditional terms? 2. What differences does the UCC make to the common law "mirror image" rule?

-

A portfolio has 75 shares of Stock A that sell for $33 per share and 110 shares of Stock B that sell for $26 per share. What is the portfolio weight of Stock A? Portfolio weight What is the portfolio...

-

What are the environmental and lifestyle factors that influence hormone levels and hormone-dependent processes, including diet, exercise, circadian rhythms, and exposure to endocrine-disrupting...

-

1-What is the difference between the Civil Law System and the Common Law System? Explain your answer. Is Saudi ArabiaaCivil Law System or a Common Law System? and Why? 2-Explain the Characteristics...

-

A market is described by the following supply and demand curves: QS = 2P QD = 300 - P a. Solve for the equilibrium price and quantity. b. If the government imposes a price ceiling of $90, does a...

-

True & False The basis of an asset must be reduced by the depreciation allowable, 2. Adjusted gross income (AGI) is the basis for a number of phase-outs of deductions. 3. A change to adjusted gross...

-

The following employees are exempt from various requirements of the FLSA. Indicate from which requirement or requirements each of the following employees is exempt: a. Amusement park employee b....

-

Abreu Company allows employees the option of carrying over unused vacation days or "cashing" them out. If they cash out, does the employer count the time or earnings when calculating overtime for...

-

Along with many other companies, Sanchez Printers observes the Friday after Thanksgiving as a paid holiday. The company requires each employee to make up Friday's lost hours in the following workweek...

-

What is the name of the following logic circuit? A < B Sum Carry

-

A Project Assistant has the responsibility of coming UP with a time estimate for a Work Package. The WP has 3 serial activities each 5 days in duration. An estimator is performing the duration for...

-

Diffie-Hellman Key Exchange Alice and Bob are trying to generate a symmetric key for them. They chose p = 5 (a public prime) and g = 3 (a public integer). Alice generated a random number A = 8 What...

Study smarter with the SolutionInn App