During 2018, Jordan Company was subject to the Alaska state unemployment tax of 4.2%. The companys taxable

Question:

During 2018, Jordan Company was subject to the Alaska state unemployment tax of 4.2%. The company’s taxable wages for FUTA were $86,700 and for SUTA, $171,000. Compute:

a. SUTA tax that Jordan Company would pay to the state of Alaska......................... $_____________

b. Net FUTA tax for 2018................................................................................................. $_____________

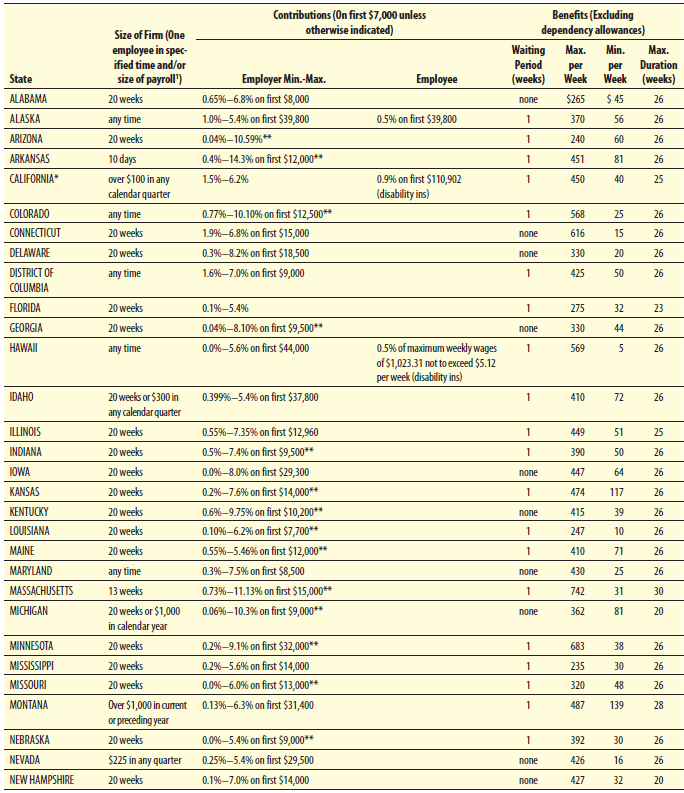

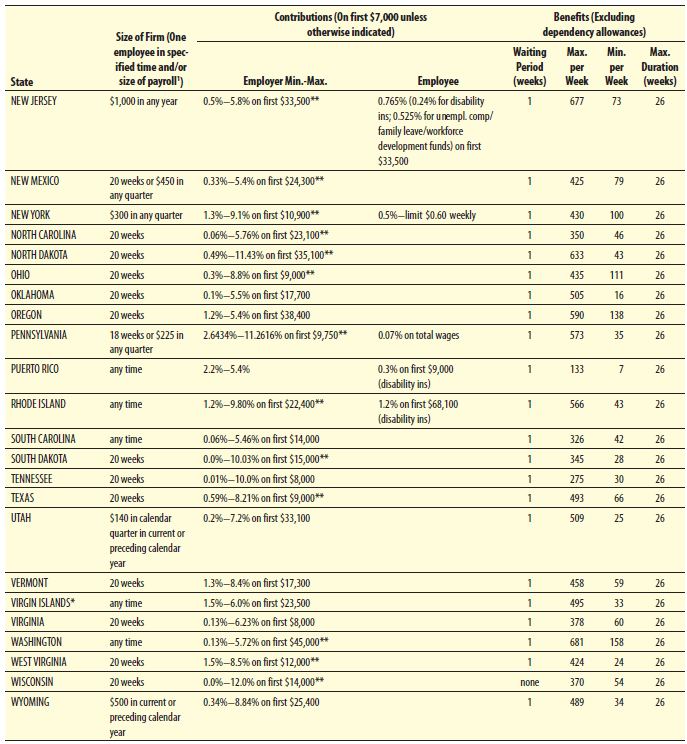

c. Amount of employees’ unemployment tax for 2018 (use the employee’s tax rate shown in Figure 5.1 on page 5-13)......................................................................... $_____________

Figure 5.1

Transcribed Image Text:

Benefits (Excluding dependency allowances) Contributions (On first $7,000 unless otherwise indicated) Size of Fim (One employee in spec- Waiting Period (weeks) Мах. Min. Мах. ified time and/or Duration per Week per size of payroll') Employer Min.-Max. Employee Week (weeks) State 20 weeks 0.65%-6.8% on first $8,000 ALABAMA $265 $ 45 26 попе 0.5% on first $39,800 ALASKA 1.0%-5.4% on first $39,800 370 56 26 any time 20 weeks ARIZONA 0.04%–10.59%** 240 60 26 ARKANSAS 10 days 0.4%–14.3% on first $12,000** 451 81 26 0.9% on first $110,902 (disability ins) CALIFORNIA* over $100 in any calendar quarter 1.5%-6.2% 450 40 25 COLORADO 0.77%–10.10% on first $12,500** any time 568 25 26 CONNECTICUT 1.9%-6.8% on first $15,000 20 weeks 616 15 26 попе DELAWARE 0.3%-8.2% on first $18,500 20 weeks 330 20 26 попе DISTRICT OF 1.6%–7.0% on first $9,000 425 50 26 any time COLUMBIA FLORIDA 20 weeks 0.1%-5.4% 275 32 23 GEORGIA 20 weeks 0.04%-8.10% on first $9,500** 330 44 26 попe 0.5% of maximum weekly wages of $1,023.31 not to exceed $5.12 per week (disability ins) HAWAII 0.0%–5.6% on first $44,000 569 26 any time IDAHO 20 weeks or $300 in 0.399%-5.4% on first $37,800 410 72 26 any calendar quarter ILLINOIS 20 weeks 0.5%-7.35% on first $12,960 449 51 25 INDIANA 20 weeks 0.5%–7.4% on first $9,500** 390 50 26 IOWA 20 weeks 0.0%–8.0% on first $29,300 447 64 26 попе KANSAS 20 weeks 0.2%–7.6% on first $14,000** 474 117 26 KENTUCKY 20 weeks 0.6%–9.75% on first $10,200** 415 39 26 попе LOUISIANA 20 weeks 0.10%-6.2% on first $7,700** 247 10 26 MAINE 20 weeks 0.5%-5.46% on first $12,000** 410 71 26 MARYLAND 0.3%–75% on first $8,500 430 25 26 попе any time 0.73%–11.13% on first $15,000** MASSACHUSETTS 13 weeks 742 31 30 20 weeks or $1,000 in calendar year MICHIGAN 0.06%–10.3% on first $9,000** 362 81 20 попе MINNESOTA 20 weeks 0.2%–9.1% on first $32,000** 683 38 26 MISSISSIPPI 20 weeks 0.2%–5.6% on first $14,000 235 30 26 0.0%-6.0% on first $13,000** MISSOURI 20 weeks 320 48 26 0.13%-6.3% on first $31,400 MONTANA Over $1,000 in current or preceding year 487 139 28 NEBRASKA 20 weeks 0.0%–5.4% on first $9,000** 392 30 26 NEVADA $225 in any quarter 0.25%-5.4% on first $29,500 426 16 26 попе 0.1%-7.0% on first $14,000 NEW HAMPSHIRE 20 weeks 427 32 20 попе Benefits (Excluding dependency allowances) Contributions (On first $7,000 unless otherwise indicated) Size of Firm (One employee in spec- Waiting Max. Min. Мах. ified time and/or Period Duration per Week per State size of payroll') Employer Min.-Max. Employee (weeks) Week (weeks) NEW JERSEY $1,000 in any year 0.5%-5.8% on first $33,500** 0.765% (0.24% for disability ins; 0.525% for u nempl comp/ family leave/workforce development funds) on first $33,500 677 73 26 NEW MEXICO 20 weeks or $450 in 0.33%-5.4% on first $24,300** 425 79 26 any quarter NEW YORK $300 in any quarter 1.3%-9.1% on first $10,900** 0.5%-limit $0.60 weekly 430 100 26 NORTH CAROLINA 20 weeks 0.06%–5.76% on first $23,100** 350 46 26 NORTH DAKOTA 20 weeks 0.49%–11.43% on first $35,100** 633 43 26 OHIO 20 weeks 0.3%-8.8% on first $9,000** 435 111 26 OKLAHOMA 20 weeks 0.1%-5.5% on first $17,700 505 16 26 OREGON 20 weeks 1.2%-5.4% on first $38,400 590 138 26 PENNSYLVANIA 18 weeks or $225 in 2.6434%–11.2616% on first $9,750** 0.07% on total wages 573 35 26 any quarter PUERTO RICO any time 2.2%-5.4% 0.3% on first $9,000 133 26 (disability ins) RHODE ISLAND 1.2%-9.80% on first $22,400** 1.2% on first $68,100 (disability ins) any time 1 566 43 26 SOUTH CAROLINA any time 0.06%–5.46% on first $14,000 326 42 26 SOUTH DAKOTA 20 weeks 0.0%–10.03% on first $15,000** 345 28 26 TENNESSEE 20 weeks 0.01%–10.0% on first $8,000 275 30 26 TEXAS 20 weeks 0.59%–8.21% on first $9,000** 493 66 26 UTAH $140 in calendar 0.2%–7.2% on first $33,100 509 25 26 quarter in current or preceding calendar year VERMONT 20 weeks 1.3%-8.4% on first $17,300 458 59 26 VIRGIN ISLANDS* any time 1.5%-6.0% on first $23,500 495 33 26 VIRGINIA 20 weeks 0.13%-6.23% on first $8,000 378 60 26 WASHINGTON any time 0.13%-5.72% on first $45,000** 681 158 26 WEST VIRGINIA 20 weeks 1.5%-8.5% on first $12,000** 424 24 26 WISCONSIN 20 weeks 0.0%–12.0% on first $14,000** none 370 54 26 WYOMING $500 in current or 0.34%-8.84% on first $25,400 489 34 26 preceding calendar year

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a 171000 0042 ...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following unemployment tax rate schedule is in effect for the calendar year 2018 in State A, which uses the reserve-ratio formula in determining employer contributions: Hyram Company, which is...

-

The information listed below refers to the employees of Lemonica Company for the year ended December 31, 2018. The wages are separated into the quarters in which they were paid to the individual...

-

What is the difference between the amortization period and the mortgage term?

-

Explain how the structure of the balance sheet corresponds to the accounting equation.

-

Determine the number of integer solutions for x1 + x2 + x3 + x4 + x5 < 40, where (a) xi 0, 1 i 5 (b) xi - 3, 1 i 5

-

The Detroit Penguins play in the American Ice Hockey League. The Penguins play in the Downtown Arena (owned and managed by the City of Detroit), which has a capacity of 15,000 seats (5,000 lower-tier...

-

On February 20, 2009, Cedar Valley Aviation, a wholly owned subsidiary of Aerial Services, Inc. (ASI), brought a Piper 522AS (Cheyenne II) in for maintenance to Des Moines Flying Service, Inc....

-

Dependable Drivers Driving School charges $250 per student to prepare and administer written and driving tests. Variable costs of $100 per student include trainers wages, study materials, and...

-

4. Find the missing angle. 16 22 5. When you are a certain distance from the base of a building, the top of the building is at an angle of 60. When you move 30 m further away, the angle is 45. How...

-

For the following state, calculate the principal normal stress 1. Write the units in MPa. Type the units in the numeric entry. Use the corresponding capital letters. Type a space between the number...

-

During 2018, Jeff Smallwood worked for two different employers. Until May, he worked for Rowland Construction Company in Ames, Iowa, and earned $22,000. The state unemployment rate for Rowland is...

-

As of June 30, 2017 (the computation date for the 2018 tax rate), Sanchez Company had a negative balance of $1,190 in its unemployment reserve account in State A. The companys average payroll over...

-

What is the effect of an agreement in which the parties state that certain terms will be discussed and agreed upon at a later date?

-

2. Given the following data, construct the ROC curve of the data. Compute the AUC. Thres hold 1 2 3 4 5 6 7 TP TN FP 0 25 7 25 18 24 26 20 29 11 29 0 0 29 FN 0 29 0 22 1 5 14 25 25 11 3 0 0 0

-

What role do threat intelligence feeds play in informing patch prioritization decisions, enabling organizations to align their patch management efforts with emerging threat landscapes and prioritize...

-

In commercializing a new product, market-entry timing is critical. Suppose your company has completed its development work on its new pet food feeder product but learns that a competitor is close to...

-

5 . 5 . Write a program Decrypt.java which takes in the name of an encrypted file as a command line argument and the name of a file containing an appropriate keypad string. This program will proceed...

-

4. "A pint's a pound the world around" is the old rhyme describing the weight of water. Given that a pint is an eighth of a gallon, and the density of freshwater is 1.93 slugs per cubic foot, solve...

-

Find an example of a recent (within the last few years) new-to-the-world consumer product. Explain how the company implemented the four Ps in launching the product and report on the product's success...

-

Express these numbers in standard notation. a. 2.87 10-8 b. 1.78 1011 c. 1.381 10-23

-

An employer, because of a favorable experience rating, is permitted to pay a state contribution at a reduced rate of 1.5 percent. What percentage of taxable wages must be paid in the aggregate to the...

-

What are two situations in which an employer could be liable for a net FUTA tax greater than 0.6 percent?

-

Can the owner of a small business receive unemployment compensation? Explain.

-

It is January 1, 2019. Find the present value of a $100 perpetuity when the first payment is at the end of year 2019. The discount rate is 6%. It is January 1, 2019. Find the present value of a $100...

-

Valley Bank has an average interest rate of 10% on %500 million of loans and securities, an average interest rate of 5% on $400 million of deposits and other borrowed funds, noninterest revenue of...

-

The current value of your portfolio is $850,000 with an expected return of 1.5% and a beta of 1.1. You are adding 15,000 shares Neuvo Inc. at at a current market value of $150,000 to your portfolio....

Study smarter with the SolutionInn App