Gallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September

Question:

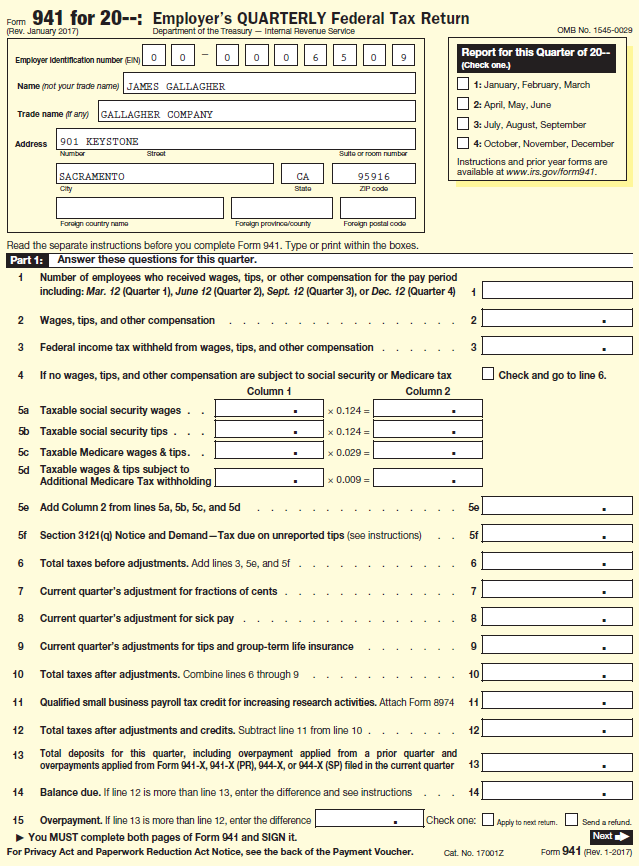

Gallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2018. Using the information presented below, complete Part 1 of Form 941, reproduced on the shown below.

# of employees for pay period that included September 12—15 employees Wages paid third quarter—$89,352.18

# of employees for pay period that included September 12—15 employees Wages paid third quarter—$89,352.18

Federal income tax withheld in the third quarter—$10,195.00

Taxable social security and Medicare wages—$89,352.18

Total tax deposits for the quarter—$23,865.92

Transcribed Image Text:

Form 941 for 20--: Employer's QUARTERLY Federal Tax Return (Rev. January 2017) Department of the Treasury – Intermal Revenue Service OMB No. 1545-0029 Report for this Quarter of 20- 9. Employer Identification number (EIN O (Check one.) 1: January, February, March Name (not your trade name) JAMES GALLAGHER 2: April, May, June Trade name frany) GALLAGHER COMPANY 3: July, August, September O 4: October, November, December 901 KEYSTONE Address Number Stroat Sutte or room number Instructions and prior year forms are available at www.irs.gov/form941. 95916 SACRAMENTO CA City Stato ZIP codo Foroign country nama Foroign provincalcounty Foroign postal codo Read the separate instructions before you complete Form 941. Type or print within the boxes. Answer these questions for this quarter. Part 1: Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 2 Wages, tips, and other compensation Federal income tax withheld from wages, tips, and other compensation 3 3 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line 6. Column 1 Column 2 Taxable social security wages. 5a x 0.124 = Taxable social security tips . 5b x 0.124 = 5c Taxable Medicare wages & tips. x 0.029 = 5d Taxable wages & tips subject to Additional Medicare Tax withholding x 0.009 = 5e Add Column 2 from lines 5a, 5b, 5c, and 5d 5e 5f Section 3121(g) Notice and Demand-Tax due on unreported tips (see instructions) 5f Total taxes before adjustments. Add lines 3, 5e, and 5f Current quarter's adjustment for fractions of cents Current quarter's adjustment for sick pay Current quarter's adjustments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9 10 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 . 12 13 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter 13 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions 14 Overpayment. If line 13 is more than line 12, enter the difference Check one: 15 U Apply to next retum. Send a refund. Next You MUST complete both pages of Form 941 and SIGN it. Form 941 (Rev. 1-2017) For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 17001Z co

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

Form 941 for 20 Employers QUARTERLY Federal Tax Return Rev January 2017 Department of the Treasury Internal Revenue Service 00000 6 Employer identific...View the full answer

Answered By

Dorcas Juliet

I am a proficient tutor and writer with over 4 years experience, I can deliver A+ works in all fields related to business and economics subject. Kindly hire me for excellent papers

4.70+

10+ Reviews

51+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2018 follow. a. Complete Schedule B of Form 941 on page 3-67 for the first...

-

During the fourth quarter of 2018, there were seven biweekly paydays on Friday (October 5, 19; November 2, 16, 30; December 14, 28) for Clarkes Roofing. Using the forms supplied on pages 4-60 to...

-

As of June 30, 2017 (the computation date for the 2018 tax rate), Amanda Company had a negative balance of $1,015 in its unemployment reserve account in State A. The companys average payroll over the...

-

Write a method \(\max ()\) that takes the first Node in a linked list as its argument and returns the value of the maximum item in the list. Assume that all items are positive integers, and return 0...

-

Determine all truth value assignments, if any, for the primitive statements p, q, r, s, t that make each of the following compound statements false. (a) [(p q) r] (s t)

-

The roller coaster car travels down the helical path at constant speed such that the parametric equations that define its position are x = c sin kt, y = c cos kt, z = h bt, where c, h, and b are...

-

In the spring of 1999, Source Associates, Inc. (Source), and Conrad A. Mamajek, Inc. (CAM), entered into a joint venture to act as a middleman for the sale of polymers manufactured by Mitsui...

-

Goltra Clinic is considering investing in new heart monitoring equipment. It has two options: Option A would have an initial lower cost but would require a significant expenditure for rebuilding...

-

x- 70 mm y 20 mm Eample 6: Determine the moment of inertia for the following area about its x centroidal axis. 40 mm 30 mm. X 25

-

Enlightened Eats in Anchorage, Alaska, has six employees who are paid semimonthly. Calculate the net pay from the information provided below for the November 15 pay date. Assume that all wages are...

-

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year: a. The total wages of...

-

Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-59) for Gallagher Company for the third quarter of 2018. Gallagher Company is a monthly depositor with the following monthly...

-

After a 5-for-1 stock split, the Strasburg Company paid a dividend of $0.75 per new share, which represents a 9% increase over last years pre-split dividend. What was last years dividend per share?

-

Business Case 1 1 : One of the local university s Student records databases was hacked. A graduate student in the computer engineering department decided to show his skills to his friends to impress...

-

Three determinates of job satisfaction: job characteristics, social information processing and dispositions. Choose 1 of these determinates and answer the following: 1. Define the determinate...

-

Wyatt Oil is a multidivisional company with activities spanning the following three industries: oil exploration, oil refining, and gas & convenience store. The following table provides some...

-

Choose any one advertising agency or speciality agency and describe their history and significance in the industry. Also discuss the services provided by them. Choose any one campaign by the same...

-

What is the biggest difference between the taxation of ordinary income and capital gains? 2. What are the tax benefits related to wealth transfers? Include any limitations or thresholds in your...

-

Three friends are choosing a TV show to watch. Here are their preferences: a. If the three friends try using a Borda count to make their choice, what would happen? b. Monica suggests a vote by...

-

Use the following data to answer the next two (2) questions: Product 1 Product 2 Product 3 Direct Material Cost $25,000 $30,000 $35,000 Direct Labor Cost $30,000 $40,000 $50,000 Direct Labor Hours...

-

What uses are made of the information shown in the employee's earnings record?

-

What personnel records would you suggest for a small retailer with three employees?

-

What kind of problem can be encountered when requesting references from previous employers of job applicants?

-

3. Consider the Allen and Gale model of contagion, where the storage asset allows the costless transfer of one unit from one time period to another and the illiquid asset pays out R = 2 in period 2...

-

A settlement is a transaction that is an irrevocable action, relieves the employer (or the plan) of primary responsibility for a pension or postretirement benefit obligation, and eliminates...

-

Explain how you may apply economic concepts when managing a business/enterprise by answering the questions What are the demand drivers of the product of interest? What are the supply drivers?...

Study smarter with the SolutionInn App