The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees

Question:

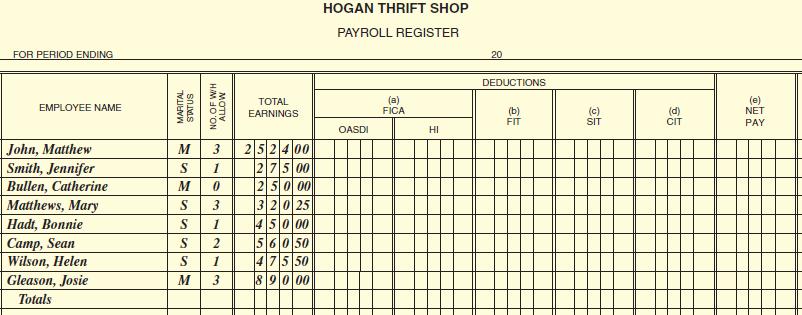

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The marital status and the number of allowances claimed are shown on the payroll register, along with each employee’s weekly salary, which has remained the same all year.

Complete the payroll register for the payroll period ending December 21, the 51st weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage-bracket method is used for federal income taxes.

Compute the employer’s FICA taxes for the pay period ending December 21.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: