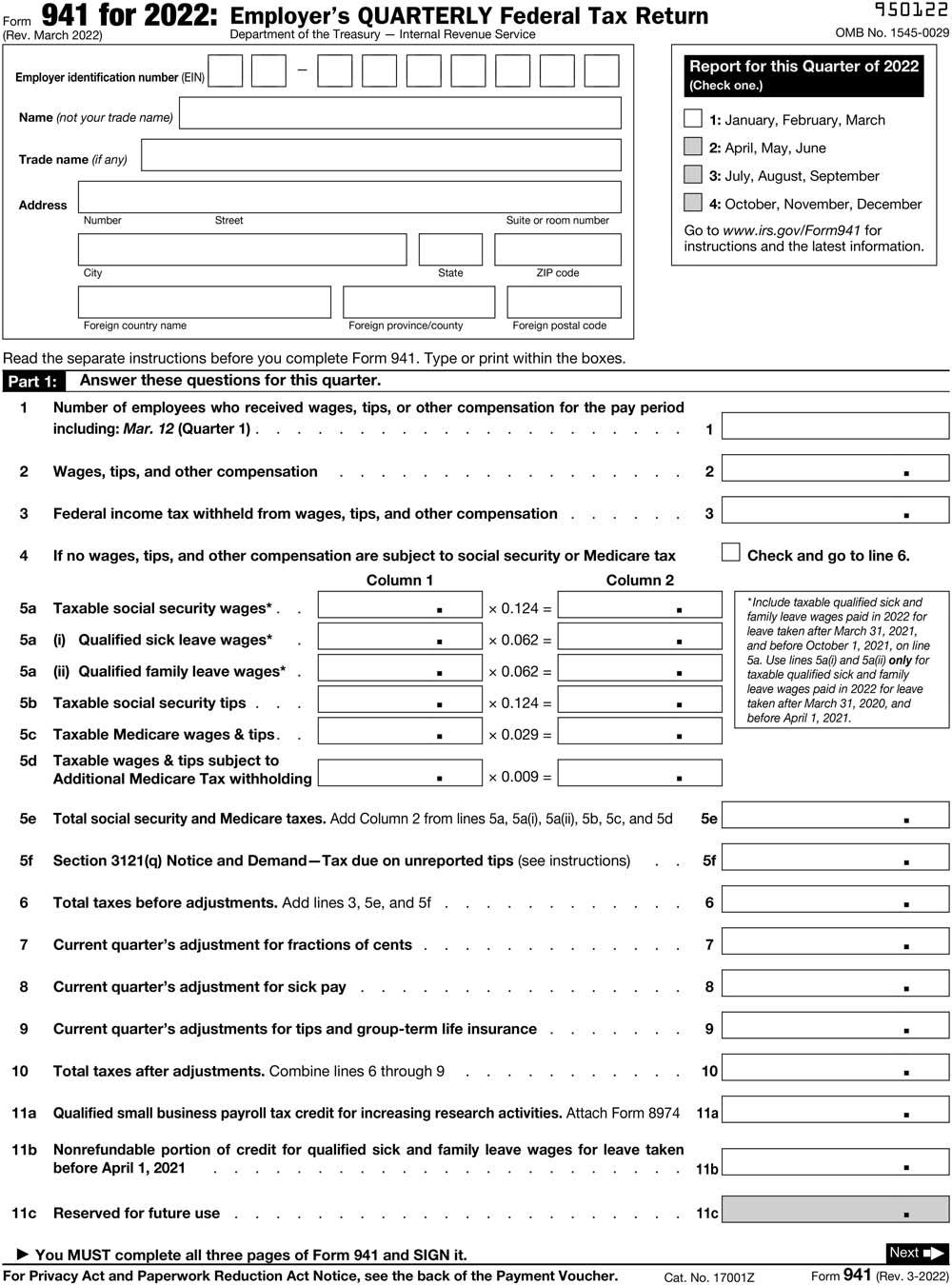

Using the information from P6-6B, complete the following form 941 for the first quarter of 2022. The

Question:

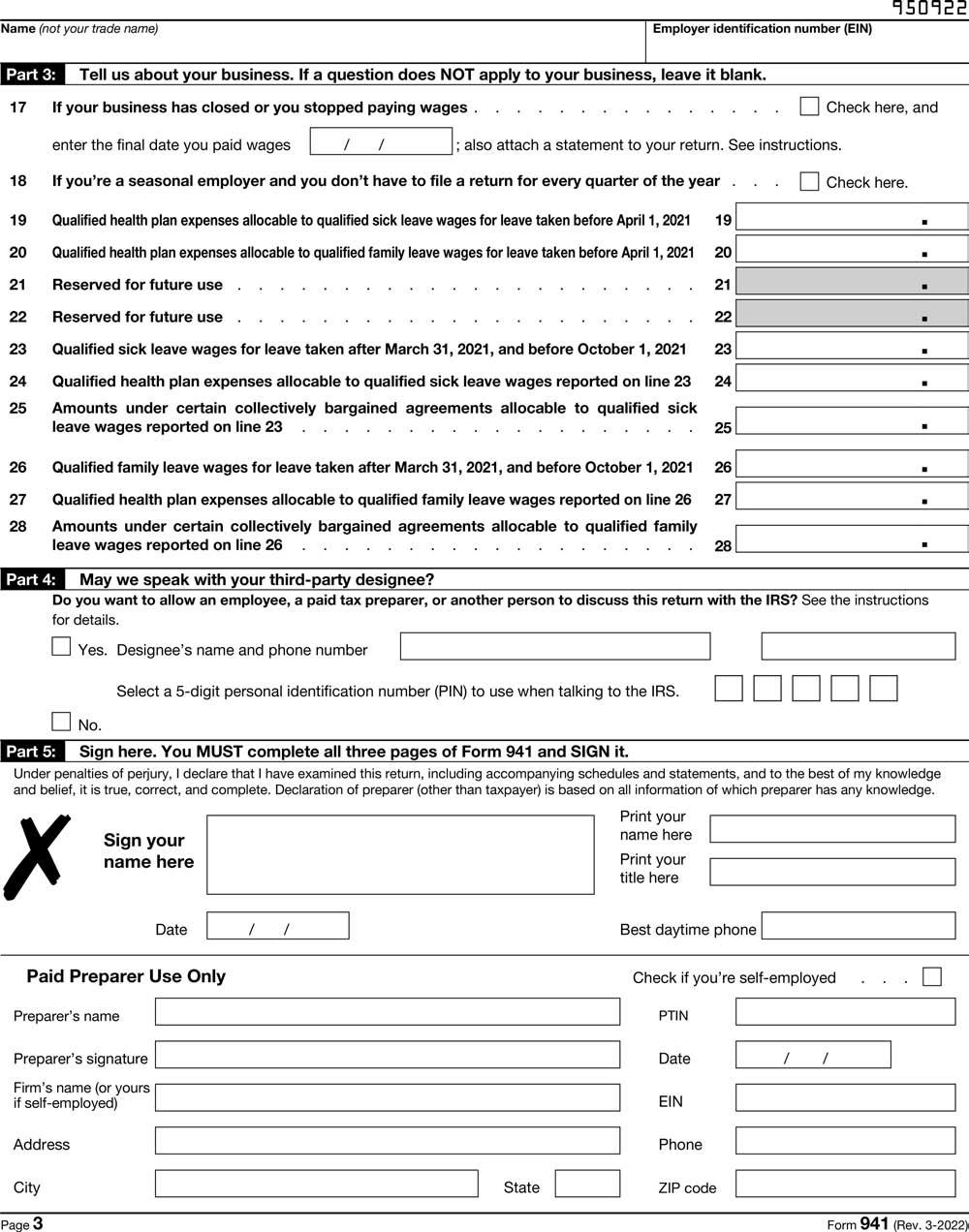

Using the information from P6-6B, complete the following form 941 for the first quarter of 2022. The form was signed by the owner on April 11, 2022.

EIN: 98-0050036

Address: 1021 Old Plainfield Road, Salina, California, 95670

Phone: 707-555-0303

Number of employees: 8

Wages, tips, and other compensation paid during the first quarter of 2022: $302,374

Social Security taxable wages: $280,000

Medicare taxable wages: $280,000

Income tax withheld: $51,000

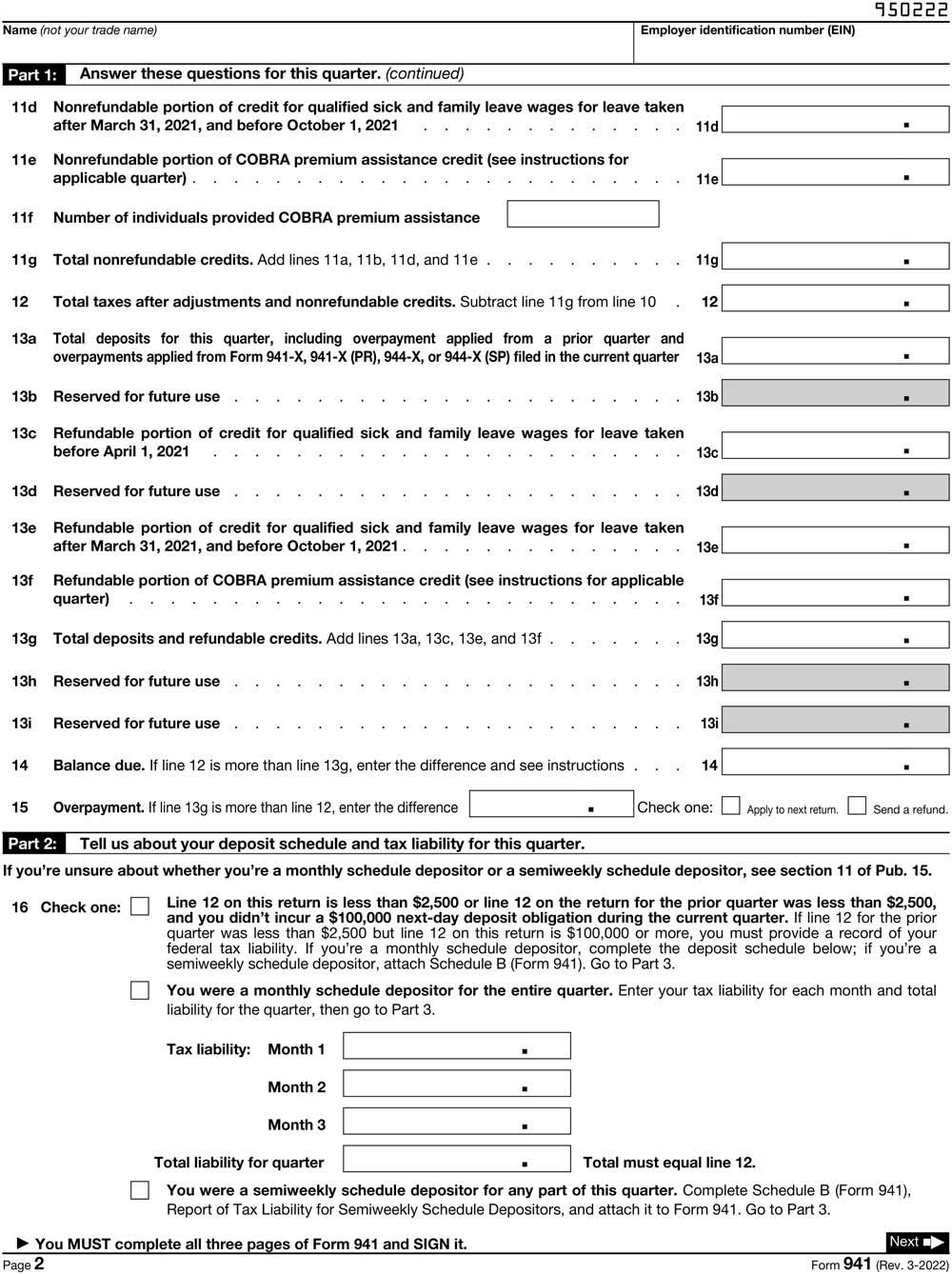

Monthly tax liability:

January $31,280.00

February 31,280.00

March 31,280.00

Transcribed Image Text:

Form 941 for 2022: Employer's QUARTERLY Federal Tax Return (Rev. March 2022) Department of the Treasury Internal Revenue Service Employer identification number (EIN) Name (not your trade name) Trade name (if any) Address 2 3 4 6 7 Foreign country name Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 8 9 Number 10 City 11a 11b Street Foreign province/county 5a Taxable social security wages*. 5a (i) Qualified sick leave wages* 5a (ii) Qualified family leave wages* 5b Taxable social security tips.. 5c Taxable Medicare wages & tips. 5d Taxable wages & tips subject to Additional Medicare Tax withholding 5e Total social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 5f Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) State . Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1)... Wages, tips, and other compensation Federal income tax withheld from wages, tips, and other compensation Total taxes before adjustments. Add lines 3, 5e, and 5f If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 Current quarter's adjustment for fractions of cents 11c Reserved for future use I Suite or room number ■ ZIP code ■ Foreign postal code · ■ . x 0.124 = x 0.062 = x 0.062 = x 0.124 = x 0.029 = × 0.009 = Current quarter's adjustment for sick pay Current quarter's adjustments for tips and group-term life insurance ► You MUST complete all three pages of Form 941 and SIGN it. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. . ■ . I 1: January, February, March 2: April, May, June 3: July, August, September 4: October, November, December Go to www.irs.gov/Form941 for instructions and the latest information. Report for this Quarter of 2022 (Check one.) 1 2 3 5e 5f 6 7 8 Total taxes after adjustments. Combine lines 6 through 9 Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11a Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021. 9 10 11b 950122 OMB No. 1545-0029 11c Check and go to line 6. *Include taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021. Cat. No. 17001Z . . Next Form 941 (Rev. 3-2022)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

Answered By

Gaurav Samadhiya

My name is gaurav samadhiya. I have finished my schooling with good academic marks and i have many merhods to teacher the students. I can solve problems in such a manner that stuent can understand easily. I have done btech so i technically good person and i have qualified gate exam which is conducted by iit. Many ofgline classes are taken by me up to 12 standard.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Using the information from P6-6A, complete the following Form 941 for the first quarter of 2022. The report was signed on April 15, 2022. EIN: 78-7654398 Address: 23051 Old Redwood Highway,...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

During the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees' salaries or wages and the amount of tips reported to...

-

What are the concepts of traditional and contemporary organizational design? Will these designs be influenced differently by management and the environment?

-

A member of the volunteer fire department for Trenton, Ohio, decided to apply the control chart methodology he learned in his business statistics class to data collected by the fire department. He...

-

Write true or false for each statement. (a) A mole of horses contain a mole of horse legs. (b) A mole of water has a mass of 18.0 g. (c) The mass of 1 molecule of water is 18.0 g. (d) A mole of...

-

Jose Garcia plans to write an email message to his father asking for a loan. He plans to use the loan to start a company to sell an environmentally friendly line of cleaning supplies that are...

-

Arid Tax Services prepares tax returns for individual and corporate clients. As the company has gradually expanded to 10 offices, the founder Max Jacobs has begun to feel as though he is losing...

-

1. In figure, two identical particles each of mass m are tied together with an inextensible string. This is pulled at its centre with a constant force F. If the whole system lies on a smooth...

-

Using the information from P6-10B for Castor Corporation, complete Form W-3 that must accompany the companys Form W-2s. Castor Corporation is a 941 payer and is a private, for-profit company. No...

-

Using the information from P6-4A, compute the employers share of the taxes. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent...

-

(a) Explain the terms credit risk, liquidity risk and market risk used in IFRS 7. (b) List the main disclosures required by IFRS 7 in relation to each of these three types of risk.

-

What are the primary, general sources of collective, inferential errors?

-

How do group members short-circuit conflict spirals?

-

Why does confirmation bias lead to defective decision making/problem solving?

-

You are the accountant of Hill Ltd (Hill), an electrical retailer having a chain of shops. Hill has recently acquired two other similar businesses. The sales director has come to you with a problem...

-

How do imagination and knowledge relate to creative problem solving?

-

An investment grew in value from $5630 to $8485 during a five-year period. The annual rate of inflation for the five years was 2.3%. What was the compound annual real rate of return during the five...

-

(a) Use integration by parts to show that (b) If f and g are inverse functions and f' is continuous, prove that (c) In the case where f and t are positive functions and b > a > 0, draw a diagram to...

-

Calculating Plantwide Predetermined Overhead Rate. Manufacturing overhead costs totaling $5,000,000 are expected for this coming year. The company also expects to use 100,000 direct labor hours and...

-

Manufacturing overhead costs totaling $500,000 are expected for this coming year$200,000 in the Assembly department and $300,000 in the Finishing department. The Assembly department expects to use...

-

Describe the four categories related to the costs of quality. How might the allocation of quality costs to these four categories help managers?

-

Jacqueline initially borrowed $7,200 from RBC Bank at 4.98% compounded monthly. After 2 years she repaid $3,528, then 5 years after the $7,200 was initially borrowed she repaid $2,160. If she pays...

-

You elect extended repayment of your subsidized student loans, and must repay $309.44/month. Your loan APR is 3.875%. How much money would you save if you repaid your debt with standard repayment...

-

Question: State the Business philosophy/Strategic themes of Fair Price group. Describe two (2) initiatives, corresponding measures and achieved targets within each of the Strategic themes. Link:...

Study smarter with the SolutionInn App