Purnell, Inc., has a semimonthly payroll of $53,900 on September 15. The total payroll is taxable under

Question:

Purnell, Inc., has a semimonthly payroll of $53,900 on September 15. The total payroll is taxable under FICA Taxes—HI; $50,400 is taxable under FICA Taxes—OASDI; and $7,300 is taxable under FUTA and SUTA. The state contribution rate for the company is 3.1%. The amount withheld for federal income taxes is $6,995. The amount withheld for state income taxes is $1,010.

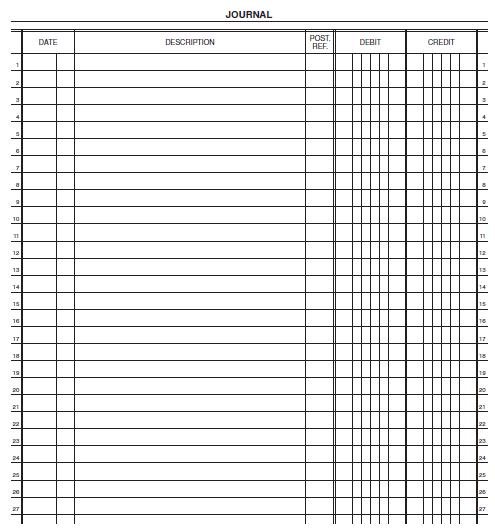

a. Journalize the payment of the wages, and record the payroll taxes on September 15.

b. Assume that the employees of Purnell, Inc., must also pay state contributions (disability insurance) of 1% on the taxable payroll of $24,100 and that the employees’ contributions are to be deducted by the employer. Journalize the September 15 payment of wages, assuming that the state contributions of the employees are kept in a separate account.

Step by Step Answer: