Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-57) for

Question:

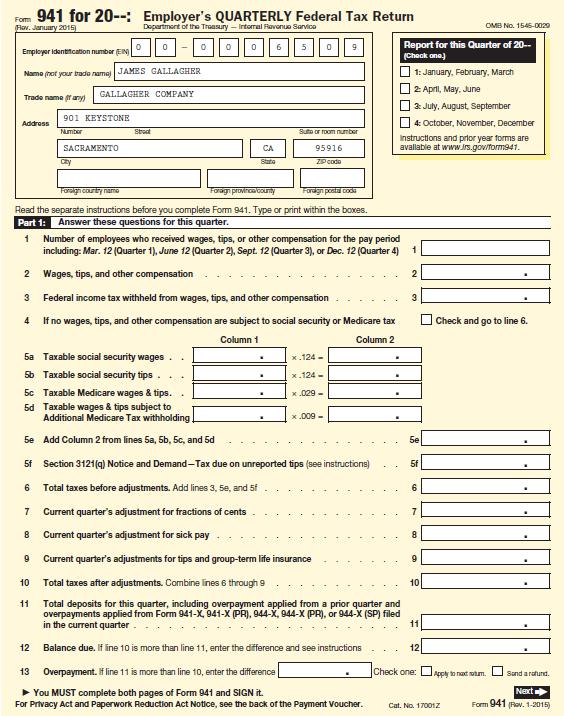

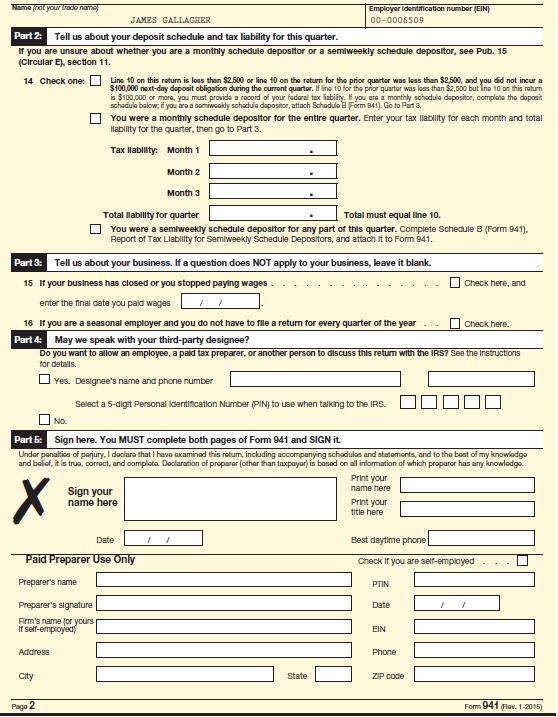

Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-57) for Gallagher Company for the third quarter of 2016. Gallagher Company is a monthly depositor with the following monthly tax liabilities for this quarter:

July $7,891.75

August 7,984.90

September 7,989.27

State unemployment taxes are only paid to California. The company does not use a third-party designee, and the tax returns are signed by the president, James Gallagher.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: