Mount Co. has the following defined-benefit pension plan balances on January 1, 2008. Projected benefit obligation.............................$4,500,000 Fair

Question:

Mount Co. has the following defined-benefit pension plan balances on January 1, 2008.

Projected benefit obligation.............................$4,500,000

Fair value of plan assets........................................4,500,000

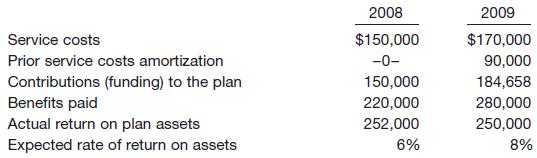

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2009, the company amends its pension agreement so that prior service costs of $600,000 are created. Other data related to the pension plan are as follows.

Instructions

(a) Prepare a pension worksheet for the pension plan in 2008.

(b) Prepare any journal entry(ies) related to the pension plan that would be needed at December 31, 2008.

(c) Prepare a pension worksheet for 2009 and any journal entry(ies) related to the pension plan as of December 31, 2009.

(d) Indicate the pension-related amounts reported in the 2009 financial statements.

Step by Step Answer:

Intermediate Accounting principles and analysis

ISBN: 978-0471737933

2nd Edition

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso