Randi Dallaire, 23, just graduated from college with a degree in marketing and landed her first job

Question:

Randi Dallaire, 23, just graduated from college with a degree in marketing and landed her first job with a local advertising agency. Now that she has achieved her first milestone—graduation—she is ready to enter the real world and make some real money. Having finished school, Randi realizes that she has the opportunity to realize many of her goals, but she is unsure as to which ones she should pursue first. Randi decides to randomly list all of the goals that she would like to accomplish and comes up with the following list:

(1) start an emergency fund,

(2) Buy a computer,

(3) Open and contribute to an RRSP account for retirement,

(4) Obtain a credit card,

(5) Save for a vacation,

(6) Pay off her student loan,

(7) Purchase life insurance,

(8) Get married someday,

(9) Have children in the future,

(10) Help take care of her parents as they get older,

(11) Learn more about the Canada Pension Plan,

(12) Buy a kitchen table for her condo,

(13) Minimize her taxes.

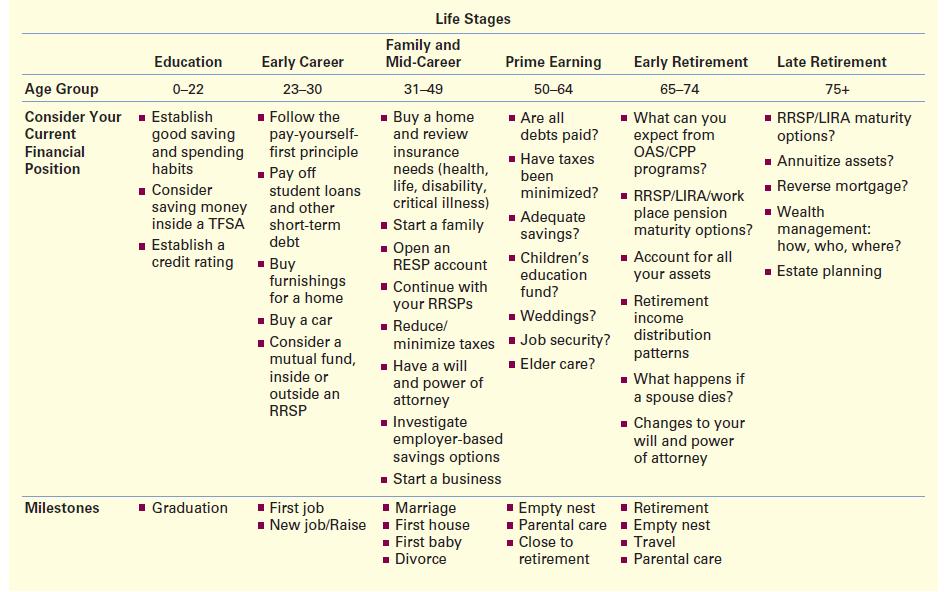

Randi is overwhelmed by all the goals that she has listed and asks you to help her prioritize them. Using the information provided in Exhibit 1.2 and the goal prioritizer calculator, located at http://cgi.money.cnn.com/tools/prioritize/prioritize_101.jsp, help Randi prioritize her goals. What assumptions did you have to make? Based on your assumptions, what goal should Randi pursue first? Second? Third? Can she pursue more than one goal at a time? Explain. NOTE: The goal prioritizer tool works best when you enter goals as one word answers. For example, enter “start an emergency fund” as “emergency.”

Exhibit 1.2

Step by Step Answer: