Monk Inc. is considering two alternatives to finance its construction of a new $4-million plant at the

Question:

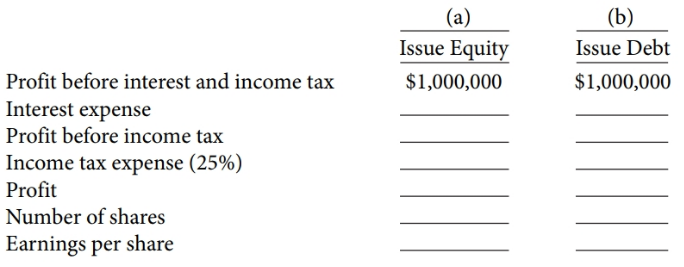

Monk Inc. is considering two alternatives to finance its construction of a new $4-million plant at the beginning of the year:

(a) Issue 200,000 common shares at a market price of $20 per share, or

(b) Issue $4 million of 6% bonds at face value. Once the new plant is built, Monk expects to earn an additional $1 million of profit before interest and income tax. It has 500,000 common shares and $10 million of shareholders equity before the new financing. Complete the following table for the year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Financial Accounting

ISBN: 9781118757147

1st Canadian Edition

Authors: Jerry J. Weygandt, Michael J. Atkins, Donald E. Kieso, Paul D. Kimmel, Valerie Ann Kinnear, Barbara Trenholm, Joan E. Barlow

Question Posted: