As the financial manager for a large multinational corporation (MNC), you have been asked to assess the

Question:

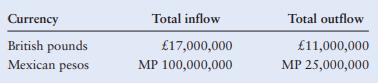

As the financial manager for a large multinational corporation (MNC), you have been asked to assess the firm’s economic exposure. The two major currencies, other than the U.S. dollar, that affect the company are the Mexican peso (MP) and the British pound (£). You have been given the projected future cash flows for next year:

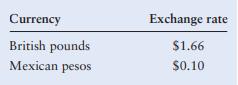

The current expected exchange rate in U.S. dollars with respect to the two currencies is as follows:

The current expected exchange rate in U.S. dollars with respect to the two currencies is as follows:

TO DO

Assume that the movements in the Mexican peso and the British pound are highly correlated. Create a spreadsheet to answer the following questions.

a. Determine the net cash flows for both the Mexican peso and the British pound.

b. Determine the net cash flow as measured in U.S. dollars. It will represent the value of the economic exposure.

c. Provide your assessment as to the company’s degree of economic exposure. In other words, is it high or low based on your findings in part b?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter