Harte Textiles, Inc., a maker of custom upholstery fabrics, is concerned about preserving the wealth of its

Question:

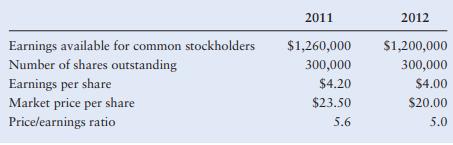

Harte Textiles, Inc., a maker of custom upholstery fabrics, is concerned about preserving the wealth of its stockholders during a cyclic downturn in the home furnishings business. The company has maintained a constant dividend payout of $2.00 tied to a target payout ratio of 40%. Management is preparing a share repurchase recommendation to present to the firm’s board of directors. The following data have been gathered from the last two years:

a. How many shares should the company have outstanding in 2012 if its earnings available for common stockholders in that year are $1,200,000 and it pays a dividend of $2.00, given that its desired payout ratio is 40%?

b. How many shares would Harte have to repurchase to have the level of shares outstanding calculated in part a?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter